Rising Disposable Incomes

The Cosmetic Surgery and Services Market is benefiting from rising disposable incomes across various regions. As individuals experience improved financial stability, they are more inclined to invest in personal aesthetics and wellness. This trend is particularly evident in emerging markets, where economic growth is fostering a burgeoning middle class with greater spending power. Data suggests that the demand for cosmetic procedures is likely to increase by approximately 12% in these regions over the next few years. Consequently, the industry is poised to expand as more consumers prioritize cosmetic enhancements as part of their lifestyle choices.

Influence of Celebrity Culture

The Cosmetic Surgery and Services Market is significantly influenced by celebrity culture and endorsements. High-profile figures often share their cosmetic experiences on social media platforms, creating a ripple effect that encourages fans to consider similar procedures. This phenomenon has been linked to a marked increase in inquiries and bookings for cosmetic surgeries, particularly among younger demographics. Research indicates that procedures associated with celebrities can see a surge in demand of up to 20% following public endorsements. As the connection between celebrity influence and consumer behavior strengthens, the market is likely to continue its upward trajectory.

Growing Awareness of Aesthetic Health

The Cosmetic Surgery and Services Market is experiencing a surge in awareness regarding aesthetic health and its impact on overall well-being. As individuals increasingly recognize the psychological benefits of cosmetic procedures, such as enhanced self-esteem and confidence, the demand for these services is expected to rise. Educational campaigns and media coverage are playing a crucial role in informing potential clients about the advantages of cosmetic surgery. Data suggests that the market could see an increase in demand by approximately 15% as more individuals seek to improve their quality of life through aesthetic enhancements. This growing awareness is likely to shape the future landscape of the industry.

Increasing Acceptance of Cosmetic Procedures

The Cosmetic Surgery and Services Market is witnessing a shift in societal attitudes towards cosmetic procedures. Increasing acceptance among various demographics, particularly among younger individuals, is driving demand. Surveys indicate that a significant percentage of millennials and Gen Z individuals view cosmetic enhancements as a means of self-expression and empowerment. This cultural shift is reflected in the rising number of procedures performed annually, with estimates suggesting a growth rate of around 8% in the coming years. As societal norms evolve, the stigma surrounding cosmetic surgery diminishes, leading to a broader customer base and increased market potential.

Technological Advancements in Cosmetic Surgery

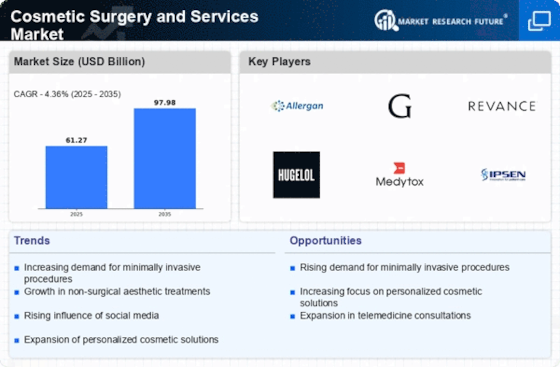

The Cosmetic Surgery and Services Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as 3D imaging, minimally invasive techniques, and robotic-assisted surgeries are enhancing precision and safety. These advancements not only improve patient outcomes but also reduce recovery times, making procedures more appealing. According to recent data, the adoption of advanced technologies is projected to increase the market size significantly, with a compound annual growth rate of approximately 10% over the next five years. As patients become more informed about these technologies, their willingness to undergo cosmetic procedures is likely to rise, further propelling the industry forward.