North America Automotive Market Summary

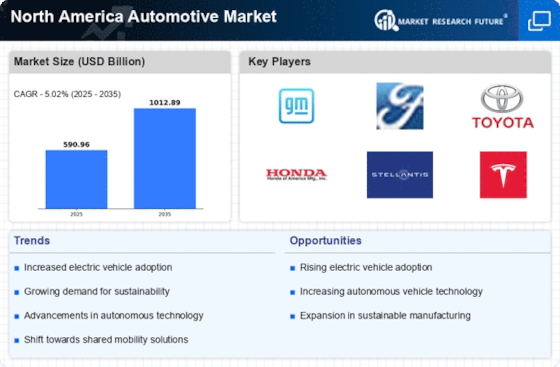

As per Market Research Future analysis, the North America Automotive Market was estimated at 590.96 USD Billion in 2024. The automotive industry is projected to grow from 620.63 USD Billion in 2025 to 1012.89 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.02% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The North America Automotive Market is experiencing a transformative shift towards electrification and connectivity.

- The rise of electric vehicles is reshaping consumer preferences and market dynamics in North America.

- Advancements in autonomous driving technology are gaining traction, particularly in urban areas across North America and Asia-Pacific.

- Digitalization and connectivity are becoming essential features in both passenger cars and two-wheelers, enhancing user experience.

- Sustainability initiatives and government regulations are driving the growth of electric vehicles and influencing market strategies.

Market Size & Forecast

| 2024 Market Size | 590.96 (USD Billion) |

| 2035 Market Size | 1012.89 (USD Billion) |

| CAGR (2025 - 2035) | 5.02% |

Major Players

General Motors (US), Ford Motor Company (US), Toyota Motor Manufacturing, California (US), Honda of America Manufacturing, Inc. (US), Stellantis North America (US), Tesla, Inc. (US), Nissan North America, Inc. (US), BMW Manufacturing Co., LLC (US), Volkswagen Group of America, Inc. (US)