Market Trends and Projections

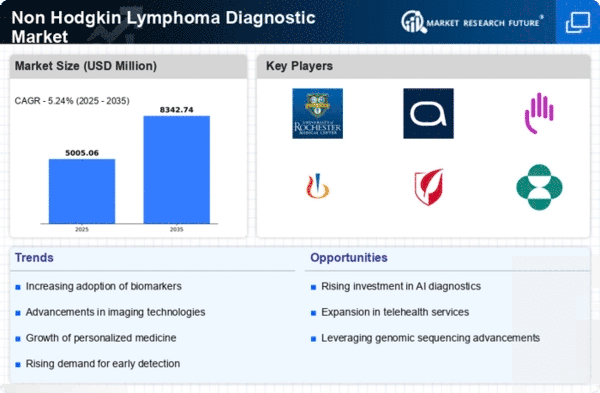

The Global Non-Hodgkin Lymphoma Diagnostic Market Industry is characterized by various trends and projections that shape its future. The market is expected to grow from 4.76 USD Billion in 2024 to 8.35 USD Billion by 2035, reflecting a robust CAGR of 5.24% from 2025 to 2035. Key trends include the integration of advanced technologies, increased funding for research, and heightened awareness of NHL. These factors collectively contribute to a dynamic market landscape, where innovation and collaboration play pivotal roles in enhancing diagnostic capabilities and improving patient outcomes.

Increased Funding for Cancer Research

The Global Non-Hodgkin Lymphoma Diagnostic Market Industry benefits from increased funding for cancer research initiatives. Governments and private organizations are allocating substantial resources to enhance diagnostic capabilities and treatment modalities for NHL. This financial support fosters innovation and accelerates the development of novel diagnostic tools. With the market projected to reach 8.35 USD Billion by 2035, the influx of funding is likely to stimulate advancements in early detection and personalized medicine. Furthermore, collaborative efforts among stakeholders, including academic institutions and pharmaceutical companies, are expected to yield significant breakthroughs in NHL diagnostics, ultimately improving patient outcomes.

Rising Incidence of Non-Hodgkin Lymphoma

The Global Non-Hodgkin Lymphoma Diagnostic Market Industry is experiencing growth driven by the increasing incidence of Non-Hodgkin Lymphoma (NHL). As per data, the global prevalence of NHL is projected to rise, with an estimated 4.76 USD Billion market value in 2024. This surge in cases necessitates advanced diagnostic techniques, fostering demand for innovative solutions. The growing awareness of NHL symptoms and the importance of early detection further contribute to this trend. Consequently, healthcare providers are investing in sophisticated diagnostic tools, which is likely to enhance patient outcomes and drive market expansion.

Growing Awareness and Education Initiatives

Growing awareness and education initiatives regarding Non-Hodgkin Lymphoma are crucial drivers of the Global Non-Hodgkin Lymphoma Diagnostic Market Industry. Public health campaigns and educational programs aim to inform individuals about NHL symptoms, risk factors, and the importance of early diagnosis. These initiatives are instrumental in encouraging individuals to seek medical attention promptly, leading to increased diagnostic testing. As awareness levels rise, healthcare systems are likely to experience heightened demand for diagnostic services, which may contribute to market growth. This trend emphasizes the need for ongoing education and outreach efforts to improve NHL detection rates.

Aging Population and Associated Health Risks

The aging population is a significant factor influencing the Global Non-Hodgkin Lymphoma Diagnostic Market Industry. As individuals age, their risk of developing various cancers, including NHL, increases. The demographic shift towards an older population is expected to drive demand for effective diagnostic solutions. With the market anticipated to grow to 8.35 USD Billion by 2035, healthcare providers are focusing on developing age-appropriate diagnostic strategies. This trend highlights the necessity for tailored approaches to address the unique health challenges faced by older adults, ultimately enhancing the effectiveness of NHL diagnostics.

Technological Advancements in Diagnostic Tools

Technological innovations are pivotal in shaping the Global Non-Hodgkin Lymphoma Diagnostic Market Industry. The advent of advanced imaging techniques, molecular diagnostics, and next-generation sequencing has revolutionized the diagnostic landscape. These technologies enable precise identification of NHL subtypes, facilitating tailored treatment approaches. As a result, the market is expected to witness a compound annual growth rate (CAGR) of 5.24% from 2025 to 2035. The integration of artificial intelligence in diagnostic processes further enhances accuracy and efficiency, potentially leading to improved patient management and outcomes. This trend underscores the importance of continuous investment in research and development.