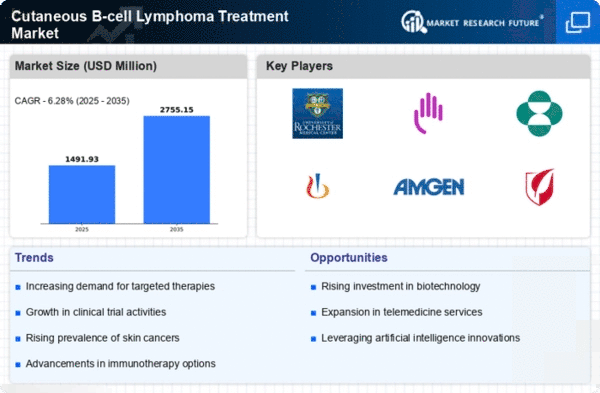

Market Growth Projections

The Global Cutaneous B-cell Lymphoma Treatment Market Industry is projected to experience substantial growth in the coming years. With an estimated market value of 1250 USD Million in 2024, the industry is on track to reach approximately 2750 USD Million by 2035. This growth trajectory suggests a compound annual growth rate of 7.43% from 2025 to 2035. Such projections indicate a robust demand for innovative treatment options and highlight the increasing focus on addressing the needs of patients suffering from cutaneous B-cell lymphoma. The anticipated growth underscores the importance of ongoing research and development efforts in this field.

Rising Awareness and Education

The Global Cutaneous B-cell Lymphoma Treatment Market Industry is benefiting from increased awareness and education regarding skin cancers. Campaigns aimed at educating both healthcare professionals and the general public about the signs and symptoms of cutaneous B-cell lymphoma are gaining traction. This heightened awareness leads to earlier diagnosis and treatment, which is crucial for improving patient outcomes. As more individuals seek medical advice upon noticing symptoms, the demand for effective treatments is likely to rise. This trend may contribute to a compound annual growth rate of 7.43% from 2025 to 2035, reflecting the industry's potential for sustained growth.

Supportive Regulatory Environment

A supportive regulatory environment plays a pivotal role in the Global Cutaneous B-cell Lymphoma Treatment Market Industry. Regulatory bodies are increasingly facilitating the approval of new therapies, which encourages pharmaceutical companies to invest in research and development. Streamlined processes for clinical trials and expedited review pathways for promising treatments are becoming more common. This regulatory support not only accelerates the availability of innovative therapies but also instills confidence in investors and stakeholders. As a result, the market is likely to see a surge in new product launches, further driving growth and enhancing treatment options for patients.

Advancements in Treatment Modalities

Innovations in treatment modalities are a crucial driver for the Global Cutaneous B-cell Lymphoma Treatment Market Industry. Recent developments in targeted therapies and immunotherapies have shown promising results in managing cutaneous B-cell lymphoma. For instance, the introduction of monoclonal antibodies has improved patient outcomes significantly. As these therapies become more widely adopted, they are likely to enhance the overall efficacy of treatment regimens. This shift towards more effective therapies is expected to propel the market, with estimates indicating a growth trajectory that could see the industry valued at 2750 USD Million by 2035. The ongoing research and development efforts further underscore the potential for market expansion.

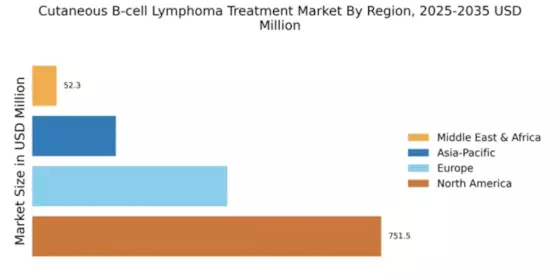

Emerging Markets and Global Expansion

Emerging markets are becoming increasingly relevant in the Global Cutaneous B-cell Lymphoma Treatment Market Industry. Regions such as Asia-Pacific and Latin America are witnessing a rise in healthcare expenditure and improved access to medical services. This expansion is creating new opportunities for pharmaceutical companies to introduce their products in these markets. As healthcare infrastructure improves, the demand for effective treatments is expected to grow. This trend may lead to a broader global footprint for companies operating in the cutaneous B-cell lymphoma space, potentially increasing market share and revenue streams.

Increasing Incidence of Cutaneous B-cell Lymphoma

The Global Cutaneous B-cell Lymphoma Treatment Market Industry is experiencing growth due to the rising incidence of cutaneous B-cell lymphoma. Epidemiological studies indicate that the prevalence of this condition is increasing, particularly in older populations. As awareness of skin cancers grows, more cases are being diagnosed, leading to a higher demand for effective treatment options. This trend is expected to contribute significantly to the market, with projections suggesting that the industry could reach approximately 1250 USD Million by 2024. The increasing number of patients necessitates advancements in treatment modalities, thereby driving innovation and investment in the sector.