Top Industry Leaders in the Non Alcoholic RTD Beverages Market

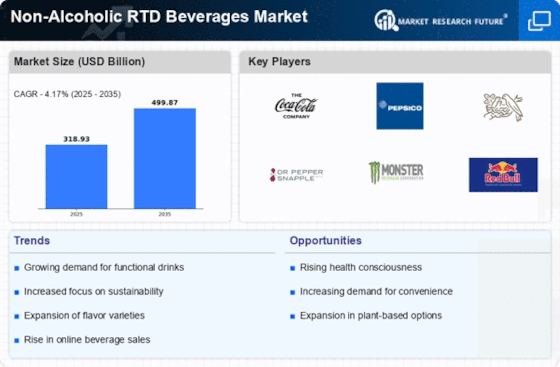

The global non-alcoholic RTD beverages market has witnessed substantial growth, driven by shifting consumer preferences towards healthier and convenient beverage options. As the market continues to expand, key players are strategically positioning themselves to cater to the increasing demand for ready-to-drink beverages without alcohol. This article provides a detailed examination of the competitive landscape, covering key players, strategies, market share factors, emerging companies, industry news, and a recent development in 2023.

Key Players:

PepsiCo (US)

Keurig Dr Pepper Inc. (US)

The Coca-Cola Company (US)

Nestlé S.A. (Switzerland)

Starbucks Corporation (US)

Danone S.A. (France)

LotteChilsungBeverage Co. Ltd. (South Korea)

Suntory Holdings Limited (Japan)

POKKA SAPPORO Food & Beverage Ltd (Japan)

and Yakult Honsha Co.

Ltd. (Japan).

Strategies Adopted:

The non-alcoholic RTD beverages market have implemented various strategies to maintain and enhance their market positions. These strategies include product diversification, marketing campaigns, acquisitions, and a focus on sustainability. For instance, The Coca-Cola Company has concentrated on introducing new and innovative RTD beverage formulations, leveraging its strong global brand presence. Collaborations with retailers and strategic partnerships have also played a crucial role in expanding market reach.

Market Share Analysis:

The non-alcoholic RTD beverages market involves evaluating multiple factors that impact competitive positioning. Key considerations include brand recognition, distribution networks, pricing strategies, and the ability to address specific consumer preferences. Companies that effectively address these factors are better positioned to capture and retain a significant share of the market. Additionally, responsiveness to changing consumer trends, such as the demand for natural and functional ingredients, contributes to a competitive advantage.

News & Emerging Companies:

The non-alcoholic RTD beverages market has seen the emergence of new and innovative companies, reflecting the industry's adaptability and potential for growth. In 2023, emerging players like Rebel Kitchen and Ugly Drinks entered the market with unique RTD beverage offerings, gaining attention for their focus on natural ingredients and minimal processing. These newcomers contribute to the market's diversity, challenging established players and fostering innovation in the non-alcoholic RTD beverages sector.

Industry Trends:

The non-alcoholic RTD beverages market revolve around health and wellness initiatives, digital marketing, and sustainable practices. Key players are investing in research and development to introduce healthier formulations, exploring digital platforms for targeted marketing, and adopting sustainable packaging practices to align with changing consumer values.

Current investment trends also highlight the significance of product innovation in line with emerging health trends. Companies are investing in functional beverages, such as those infused with vitamins, minerals, and botanicals, to meet the growing demand for beverages that offer health benefits beyond hydration. Additionally, investments in eco-friendly packaging materials contribute to meeting the rising consumer demand for sustainability in the non-alcoholic RTD beverages market.

Competitive Scenario:

The non-alcoholic RTD beverages market is marked by intense rivalry among key players striving to establish themselves as leaders in this dynamic sector. Companies are strategically differentiating themselves through a combination of product innovation, marketing strategies, and a focus on meeting diverse consumer preferences. The market is also shaped by factors such as brand loyalty, partnerships, and the ability to adapt to regional taste preferences.

Recent Development

The non-alcoholic RTD beverages market was the launch of a new line of functional wellness beverages by Nestlé S.A. This innovation marked a response to the growing consumer interest in beverages that offer health benefits beyond basic hydration. The functional wellness beverages were formulated with natural ingredients known for their health-promoting properties, aligning with the broader trend towards functional and health-focused beverages.

Nestlé's strategic move showcased the importance of staying attuned to consumer preferences and incorporating health and wellness aspects into product offerings. The development positioned the company as a frontrunner in providing innovative non-alcoholic RTD beverages, reinforcing its commitment to addressing evolving consumer needs. This move not only expanded Nestlé's product portfolio but also contributed to the broader industry shift towards beverages that cater to health-conscious consumers.