Growth in the Printing Industry

The growth in the printing industry is another vital driver influencing The Global Nitrocellulose Industry. Nitrocellulose Market is a key ingredient in various printing inks, particularly in flexographic and gravure printing processes. The Global Nitrocellulose Market has been expanding, with a projected compound annual growth rate (CAGR) of 3.5% over the next five years. This growth is attributed to the rising demand for packaging materials and printed media. As the printing industry evolves, the need for high-quality inks that offer vibrant colors and quick drying times will likely enhance the demand for nitrocellulose, thereby positively impacting market trends.

Expansion of the Automotive Sector

The expansion of the automotive sector serves as a significant catalyst for The Global Nitrocellulose Industry. Nitrocellulose Market is extensively used in automotive paints and coatings, which are essential for enhancing vehicle aesthetics and durability. The automotive industry has witnessed a resurgence in production levels, with an estimated growth rate of 5% annually. This growth translates into increased demand for high-quality coatings, where nitrocellulose plays a crucial role. As manufacturers strive to meet consumer preferences for innovative and durable finishes, the reliance on nitrocellulose is likely to intensify, thereby bolstering market dynamics.

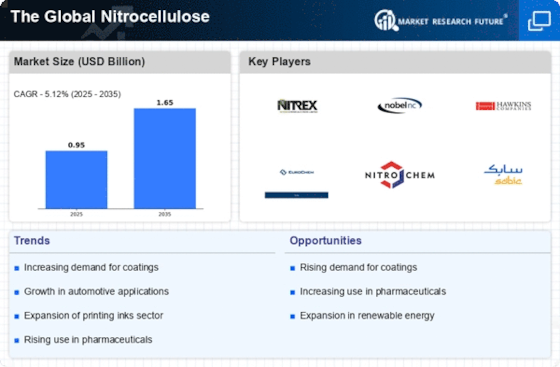

Rising Demand in Coatings and Inks

The increasing demand for nitrocellulose in coatings and inks is a pivotal driver for The Global Nitrocellulose Industry. Nitrocellulose Market is widely utilized in the production of lacquers, varnishes, and inks due to its excellent film-forming properties and quick-drying capabilities. The coatings segment is projected to account for a substantial share of the market, driven by the growth in the automotive and construction sectors. In 2023, the coatings segment represented approximately 40% of the total nitrocellulose consumption, indicating a robust market presence. As industries continue to seek high-performance materials, the reliance on nitrocellulose is expected to escalate, further propelling market growth.

Technological Innovations in Production

Technological innovations in the production of nitrocellulose are poised to drive The Global Nitrocellulose Industry forward. Advances in manufacturing processes have led to improved efficiency and reduced environmental impact, making nitrocellulose production more sustainable. Innovations such as solvent recovery systems and enhanced purification techniques are being adopted, which not only optimize production but also align with global sustainability goals. As manufacturers increasingly focus on eco-friendly practices, the adoption of these technologies is expected to elevate the market's growth trajectory, catering to the evolving demands of consumers and regulatory bodies alike.

Increasing Applications in Pharmaceuticals

The increasing applications of nitrocellulose in the pharmaceutical sector represent a noteworthy driver for The Global Nitrocellulose Industry. Nitrocellulose Market is utilized in the formulation of various pharmaceutical products, including coatings for tablets and capsules, due to its biocompatibility and film-forming properties. The pharmaceutical industry is experiencing steady growth, with an anticipated CAGR of 4% over the next few years. This growth is likely to enhance the demand for nitrocellulose as manufacturers seek reliable excipients for drug delivery systems. As the pharmaceutical landscape evolves, the role of nitrocellulose in enhancing product efficacy and stability is expected to become increasingly prominent.