Market Analysis

In-depth Analysis of Nitrocellulose Market Industry Landscape

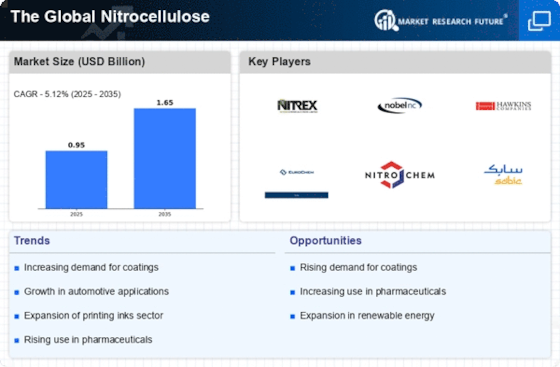

The nitrocellulose market is driven by a complex interplay of supply, demand, and various external factors. Nitrocellulose, also known as cellulose nitrate or guncotton, is a highly versatile compound widely used in industries ranging from automotive to printing to pharmaceuticals. Its market dynamics are influenced by several key factors.

On basis of application, the global Nitrocellulose market can be segmented into Printing inks, automotive paints, wood coatings, leather finishes, nail varnishes and others .print inking inks is driven by technology advancement and eco-friendly inks. Print inking inks is largest application industry of nitrocellulose market. automotive paints is second largest segment in Nitrocellulose.

Firstly, demand for nitrocellulose is heavily reliant on its applications across different industries. In the automotive sector, nitrocellulose finds use in coatings and finishes due to its fast-drying and durable properties, driving demand from automobile manufacturers. Similarly, in the printing industry, it serves as a key component in ink formulations, impacting demand from publishing houses and packaging companies. Moreover, its use in pharmaceuticals as a binding agent further diversifies its market dynamics.

Secondly, the availability and cost of raw materials play a significant role in shaping the nitrocellulose market. Nitrocellulose is primarily derived from cellulose, which is obtained from wood pulp or cotton. Fluctuations in the prices of these raw materials, influenced by factors such as weather conditions, geopolitical tensions, and supply chain disruptions, directly impact production costs and subsequently affect market dynamics. Additionally, regulatory policies regarding the sourcing of raw materials can also influence market trends.

Furthermore, technological advancements and innovations contribute to the evolution of the nitrocellulose market dynamics. Continuous research and development efforts aimed at enhancing product quality, efficiency, and sustainability drive market growth. For instance, the development of eco-friendly manufacturing processes and the introduction of novel applications broaden the scope of nitrocellulose usage, consequently affecting market demand and competition.

Moreover, market dynamics are significantly influenced by global economic conditions and geopolitical factors. Economic growth, trade policies, currency fluctuations, and geopolitical tensions can all impact the demand-supply balance within the nitrocellulose market. For instance, during periods of economic downturn, demand from certain industries may decrease, leading to a surplus in supply and downward pressure on prices. Conversely, geopolitical conflicts or trade disputes can disrupt supply chains and result in supply shortages, affecting market dynamics.

Regulatory policies and environmental considerations also shape the nitrocellulose market dynamics. Stringent regulations regarding product safety, environmental impact, and workplace health and safety standards influence manufacturing practices and market trends. Compliance with regulatory requirements adds additional costs to producers and may impact pricing strategies and market competitiveness.

Lastly, consumer preferences and societal trends play a role in shaping the nitrocellulose market dynamics. Increasing awareness of environmental sustainability and health concerns drive demand for eco-friendly and non-toxic products, influencing manufacturers to develop and market nitrocellulose-based products that align with these preferences. Similarly, changing consumer lifestyles and preferences for convenience and efficiency drive innovation and demand for nitrocellulose-based products in various applications.

Leave a Comment