Growing E-commerce Sector

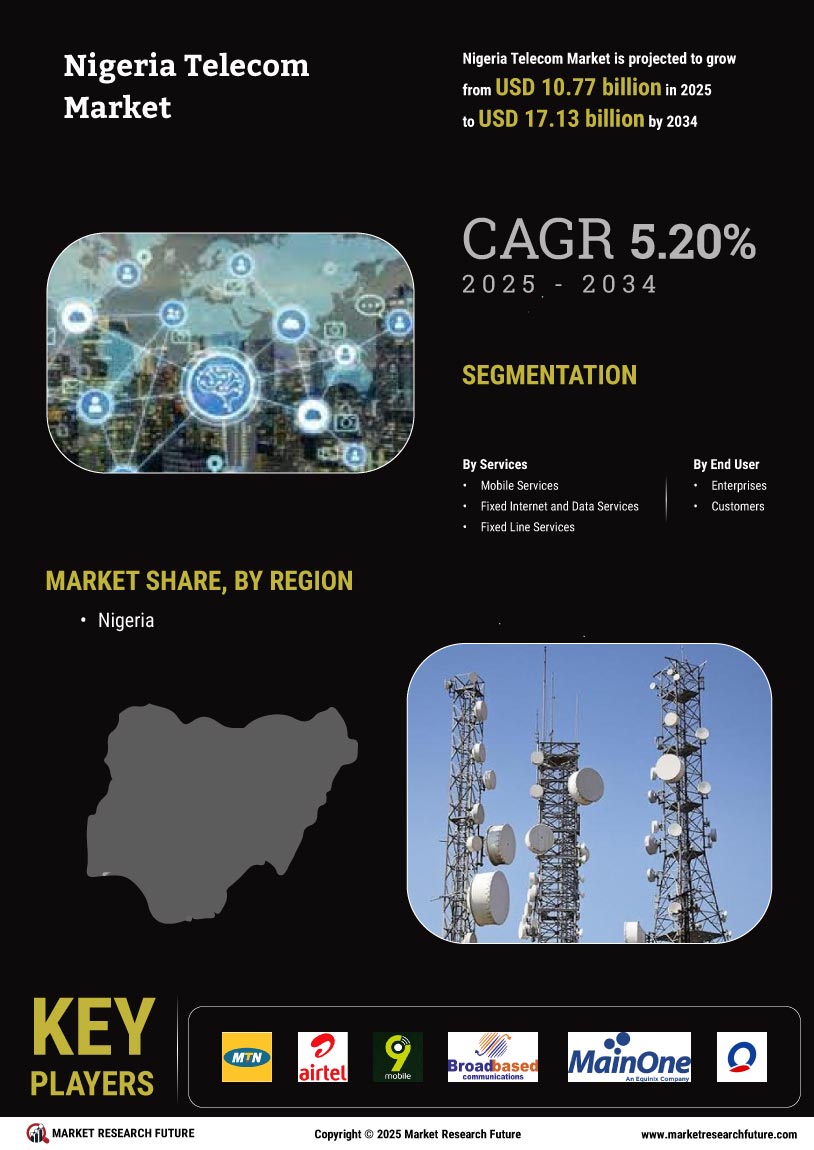

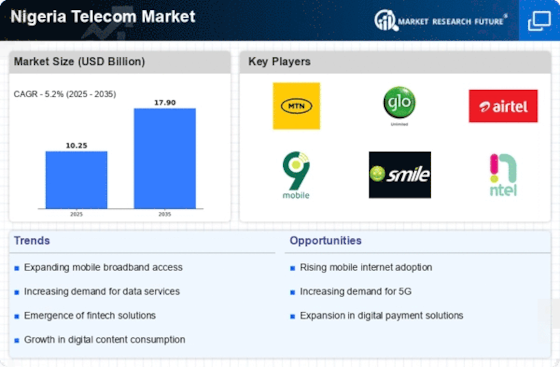

The burgeoning e-commerce sector in Nigeria serves as a vital driver for the Nigeria Telecom Market. As online shopping becomes increasingly popular, the demand for reliable internet connectivity has surged. Reports indicate that e-commerce transactions in Nigeria are projected to reach billions of dollars by the end of 2025, necessitating robust telecom infrastructure to support this growth. Telecom operators are likely to respond by enhancing their service offerings, ensuring that consumers have access to high-speed internet for seamless online shopping experiences. This trend not only benefits telecom companies through increased data usage but also stimulates economic growth by facilitating trade and commerce. The interplay between e-commerce and telecommunications is expected to further solidify the position of the Nigeria Telecom Market in the broader economic landscape.

Rising Smartphone Penetration

The increasing penetration of smartphones in Nigeria is a pivotal driver for the Nigeria Telecom Market. As of October 2025, smartphone adoption rates have surged, with estimates suggesting that over 80% of mobile users possess smartphones. This trend facilitates access to mobile internet services, thereby enhancing user engagement with digital platforms. The proliferation of affordable smartphones has made it feasible for a broader demographic to connect to the internet, which in turn stimulates demand for data services. Consequently, telecom operators are likely to invest in expanding their network infrastructure to accommodate the growing data traffic. This shift not only boosts revenue for telecom companies but also fosters a more connected society, ultimately propelling the Nigeria Telecom Market forward.

Emergence of Fintech Solutions

The rise of fintech solutions is transforming the Nigeria Telecom Market by integrating financial services with telecommunications. As of October 2025, mobile money services have gained significant traction, with millions of Nigerians utilizing their mobile devices for transactions. This convergence of telecom and finance has prompted telecom operators to diversify their service offerings, incorporating mobile banking and payment solutions. The collaboration between telecom companies and fintech startups is likely to enhance financial inclusion, particularly in rural areas where traditional banking services are limited. This trend not only drives revenue growth for telecom operators but also positions them as key players in the financial ecosystem, thereby reshaping the competitive landscape of the Nigeria Telecom Market.

Increased Demand for Data Services

The escalating demand for data services is a significant catalyst for the Nigeria Telecom Market. With the rise of social media, streaming services, and online gaming, consumers are increasingly reliant on mobile data. Reports indicate that mobile data consumption in Nigeria has grown exponentially, with users consuming an average of 10GB per month as of October 2025. This trend compels telecom operators to enhance their data offerings and invest in advanced technologies such as 4G and 5G networks. The competition among service providers to deliver faster and more reliable data services is likely to intensify, further driving innovation within the Nigeria Telecom Market. As a result, consumers may benefit from improved service quality and competitive pricing, which could lead to a more dynamic market landscape.

Government Initiatives and Policies

Government initiatives aimed at improving telecommunications infrastructure play a crucial role in shaping the Nigeria Telecom Market. The Nigerian government has implemented various policies to encourage investment in the telecom sector, including tax incentives and public-private partnerships. These initiatives are designed to enhance connectivity in underserved areas, thereby expanding the market reach of telecom operators. As of October 2025, the government has set ambitious targets for broadband penetration, aiming for 70% coverage by 2027. Such policies not only attract foreign investment but also stimulate local entrepreneurship in the telecom space. The collaborative efforts between the government and private sector are likely to yield a more robust telecommunications framework, ultimately benefiting consumers and businesses alike within the Nigeria Telecom Market.