Adoption of Edge Computing Solutions

The rise of edge computing is reshaping the landscape of the FPGA in Telecom Sector Market. As data processing moves closer to the source of data generation, telecom operators are increasingly deploying edge computing solutions to reduce latency and improve service delivery. FPGAs are particularly well-suited for edge applications due to their ability to process data in real-time and their low power consumption. This trend is expected to drive significant investments in FPGA technology, as telecom companies seek to enhance their infrastructure to support edge computing. The market for edge computing in telecom is anticipated to grow at a rate of approximately 15% annually, further solidifying the role of FPGAs in this evolving environment.

Growing Need for Network Virtualization

The shift towards network virtualization is a critical driver in the FPGA in Telecom Sector Market. As telecom operators seek to enhance flexibility and scalability in their networks, virtualization technologies are becoming increasingly prevalent. FPGAs play a vital role in enabling network functions virtualization (NFV) by providing the necessary processing power to handle virtualized network functions efficiently. This trend is expected to accelerate as telecom companies aim to reduce capital expenditures and improve operational efficiency. The NFV market is anticipated to witness substantial growth, with projections indicating a multi-billion dollar valuation in the coming years, highlighting the essential role of FPGAs in this transformative process.

Regulatory Push for Enhanced Network Security

Regulatory requirements for enhanced network security are driving the adoption of FPGAs in the Telecom Sector Market. As cyber threats become more sophisticated, telecom operators are compelled to implement robust security measures to protect sensitive data and maintain customer trust. FPGAs offer unique advantages in developing security protocols and encryption algorithms, enabling telecom companies to safeguard their networks effectively. The increasing focus on compliance with regulations such as GDPR and CCPA is likely to propel the demand for FPGA solutions that can address these security challenges. The market for telecom security solutions is projected to grow significantly, further emphasizing the importance of FPGAs in ensuring secure communication.

Increased Demand for High-Speed Data Transmission

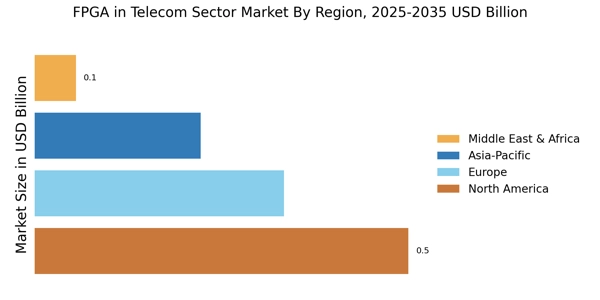

The demand for high-speed data transmission is a primary driver in the FPGA in Telecom Sector Market. As consumers and businesses increasingly rely on data-intensive applications, the need for faster and more reliable communication networks has surged. FPGAs offer the flexibility and performance required to support advanced modulation schemes and high-bandwidth applications. According to recent estimates, the telecom sector is projected to experience a compound annual growth rate of over 10% in the next five years, largely driven by the expansion of 5G networks. This growth necessitates the deployment of FPGAs, which can be reconfigured to meet evolving standards and protocols, thereby enhancing network efficiency and performance.

Emergence of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) into telecom operations is a notable driver in the FPGA in Telecom Sector Market. Telecom companies are increasingly leveraging AI and ML to optimize network performance, enhance customer experience, and reduce operational costs. FPGAs provide the necessary computational power and flexibility to implement complex algorithms and data processing tasks efficiently. As the telecom sector continues to embrace digital transformation, the demand for FPGAs that can support AI and ML applications is expected to rise. Market analysts predict that the AI in telecom market will reach several billion dollars by 2026, indicating a substantial opportunity for FPGA technology to play a pivotal role in this transformation.