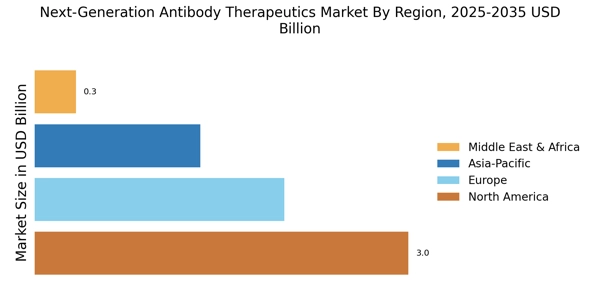

By region, the study provides the market insights into North America, Europe, Asia-Pacific and the Rest of the World. The North American Next-Generation Antibody Therapeutics market area will dominate this market high prevalence of chronic diseases. North America has secured the largest market share in the Next-Generation Antibody Therapeutics Market due to several factors. The region boasts a robust healthcare infrastructure, extensive research and development activities, and favorable regulatory policies that support innovation. Additionally, a large patient population, a high prevalence of chronic diseases, and significant investments in biopharmaceutical research contribute to the dominance of North America in the market.

Moreover, the presence of key market players and academic institutions further strengthens the region's position in driving advancements and adoption of next-generation antibody therapeutics.

Further, the major countries studied in the market report are the US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: NEXT-GENERATION ANTIBODY THERAPEUTICS MARKET SHARE BY REGION 2023 (USD Billion)

Europe Next-Generation Antibody Therapeutics market accounts for the second-largest market share due to the strong regulatory framework. Europe has secured the second-largest market share in the Next-Generation Antibody Therapeutics Market due to several factors. The region benefits from a well-established healthcare system, strong regulatory framework, and active participation in clinical research and development. Additionally, Europe has a high prevalence of chronic diseases, driving the demand for innovative therapies. Furthermore, strategic collaborations between academic institutions, biopharmaceutical companies, and government bodies foster innovation and contribute to the region's significant presence in the market.

Further, the German Next-Generation Antibody Therapeutics market held the largest market share, and the UK Next-Generation Antibody Therapeutics market was the fastest growing market in the European region.

The Asia-Pacific Next-Generation Antibody Therapeutics Market is expected to grow at the fastest CAGR from 2025 to 2034. The Asia Pacific region is experiencing the highest compound annual growth rate (CAGR) in the Next-Generation Antibody Therapeutics Market due to several factors. These include increasing investments in healthcare infrastructure, rising prevalence of chronic diseases, and expanding research and development activities. Additionally, favorable regulatory reforms, growing healthcare expenditure, and the presence of a large patient population drive market growth in the region.

Moreover, strategic partnerships and collaborations with global biopharmaceutical companies contribute to the accelerated adoption of next-generation antibody therapeutics in the Asia Pacific region. Moreover, China’s Next-Generation Antibody Therapeutics market held the largest market share, and the Indian Next-Generation Antibody Therapeutics market was the fastest growing market in the Asia-Pacific region.