Demand for Enhanced Data Security

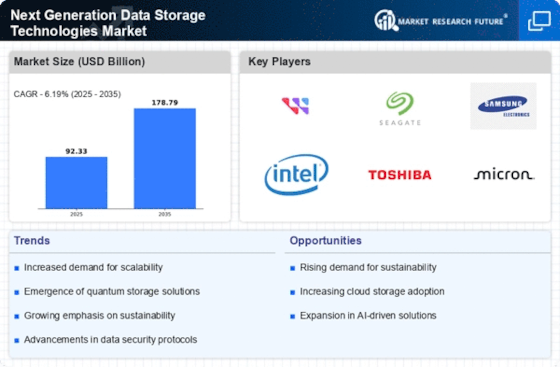

In an era where data breaches and cyber threats are increasingly prevalent, the demand for enhanced data security is a significant driver of the Next Generation Data Storage Technologies Market. Organizations are compelled to adopt storage solutions that not only provide high capacity but also robust security features. The market is responding to this need by developing technologies that incorporate advanced encryption, access controls, and data integrity measures. As per industry reports, The Next Generation Data Storage Technologies Market is expected to grow at a compound annual growth rate of over 10% through 2025. This trend indicates a strong correlation between the need for secure data storage and the growth of the Next Generation Data Storage Technologies Market, as businesses prioritize safeguarding sensitive information against potential threats.

Rising Data Volume and Complexity

The exponential growth of data generated across various sectors is a primary driver for the Next Generation Data Storage Technologies Market. As organizations increasingly rely on data analytics for decision-making, the volume and complexity of data continue to escalate. According to recent estimates, the total amount of data created globally is projected to reach 175 zettabytes by 2025. This surge necessitates advanced storage solutions that can efficiently manage, store, and retrieve vast amounts of information. Traditional storage methods are often inadequate, leading to a pressing demand for innovative technologies that can handle this data deluge. Consequently, the Next Generation Data Storage Technologies Market is witnessing a shift towards solutions that offer scalability, speed, and reliability, ensuring that businesses can harness the full potential of their data.

Shift Towards Hybrid Storage Solutions

The transition towards hybrid storage solutions is reshaping the landscape of the Next Generation Data Storage Technologies Market. Organizations are increasingly adopting a combination of on-premises and cloud storage to optimize performance and cost-efficiency. This hybrid approach allows businesses to leverage the benefits of both storage types, ensuring flexibility and scalability. Market analysis suggests that the hybrid cloud storage market is expected to witness substantial growth, with projections indicating a value exceeding 100 billion dollars by 2026. This shift is driven by the need for organizations to balance data accessibility with security and compliance requirements. As a result, the Next Generation Data Storage Technologies Market is evolving to offer integrated solutions that cater to the diverse needs of enterprises, facilitating seamless data management across various environments.

Regulatory Compliance and Data Governance

Regulatory compliance and data governance are increasingly influencing the Next Generation Data Storage Technologies Market. As data protection regulations become more stringent, organizations are required to implement storage solutions that ensure compliance with laws such as GDPR and CCPA. This regulatory landscape compels businesses to adopt technologies that facilitate data management, retention, and deletion in accordance with legal requirements. The market is witnessing a surge in demand for storage solutions that offer built-in compliance features, enabling organizations to mitigate risks associated with non-compliance. Analysts predict that the compliance-driven storage market will experience significant growth, as businesses prioritize investments in technologies that support their governance frameworks. Consequently, the Next Generation Data Storage Technologies Market is adapting to meet these evolving regulatory demands, ensuring that organizations can navigate the complexities of data governance effectively.

Technological Advancements in Storage Media

Technological advancements in storage media are propelling the Next Generation Data Storage Technologies Market forward. Innovations such as 3D NAND technology, NVMe interfaces, and DNA data storage are revolutionizing how data is stored and accessed. These advancements not only enhance storage capacity but also significantly improve data transfer speeds and energy efficiency. For instance, NVMe technology can deliver speeds up to six times faster than traditional SATA SSDs, making it a preferred choice for high-performance applications. The ongoing research and development in storage technologies indicate a robust pipeline of innovations that will continue to drive the market. As organizations seek to optimize their data storage capabilities, the Next Generation Data Storage Technologies Market is likely to benefit from these cutting-edge developments, which promise to redefine data storage paradigms.