- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

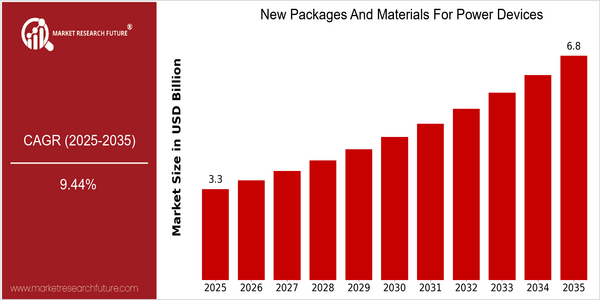

| Year | Value |

|---|---|

| 2025 | USD 3.26 Billion |

| 2035 | USD 6.78 Billion |

| CAGR (2025-2035) | 9.44 % |

Note – Market size depicts the revenue generated over the financial year

The New Packages and Materials for Power Devices market is poised for significant growth, with a current market size of USD 3.26 billion in 2025 projected to nearly double to USD 6.78 billion by 2035. This growth trajectory reflects a robust compound annual growth rate (CAGR) of 9.44% over the forecast period. The increasing demand for efficient power management solutions, driven by the proliferation of electric vehicles, renewable energy systems, and advanced consumer electronics, is a primary catalyst for this expansion. As industries seek to enhance energy efficiency and reduce thermal management challenges, innovative packaging materials and technologies are becoming essential. Key players in this market, such as Infineon Technologies, Texas Instruments, and ON Semiconductor, are actively investing in research and development to create advanced packaging solutions that improve performance and reliability. Strategic initiatives, including partnerships with semiconductor manufacturers and investments in next-generation materials, are further propelling market growth. The ongoing trend towards miniaturization and the need for higher power density in electronic devices are also contributing to the increasing adoption of new packaging technologies, solidifying the market's upward trajectory.

Regional Market Size

Regional Deep Dive

The New Packages and Materials for Power Devices Market is experiencing significant growth across various regions, driven by the increasing demand for energy-efficient solutions and advancements in semiconductor technology. In North America, the market is characterized by a strong emphasis on innovation and sustainability, with key players investing heavily in research and development to create advanced packaging solutions. Europe is witnessing a surge in regulatory support for green technologies, while Asia-Pacific is rapidly becoming a manufacturing hub for power devices, leveraging its cost advantages and skilled workforce. The Middle East and Africa are gradually adopting new technologies, influenced by government initiatives aimed at diversifying their economies. Latin America, while still emerging, is beginning to recognize the importance of modern power device packaging in supporting its growing electronics sector.

Europe

- The European Union's Green Deal is driving investments in sustainable packaging materials for power devices, with companies like Infineon Technologies focusing on eco-friendly solutions to meet regulatory requirements.

- Recent collaborations between major semiconductor firms and research institutions in Germany aim to develop next-generation packaging technologies that enhance the reliability and efficiency of power devices.

Asia Pacific

- China's push for self-sufficiency in semiconductor manufacturing has led to increased investments in local packaging technologies, with companies like BYD and Huawei developing proprietary materials for power devices.

- Japan is focusing on advanced materials research, with organizations such as the New Energy and Industrial Technology Development Organization (NEDO) funding projects aimed at improving the performance of power device packaging.

Latin America

- Brazil is beginning to implement policies that encourage the development of local semiconductor industries, which includes a focus on modern packaging materials for power devices.

- Emerging tech hubs in countries like Mexico are attracting foreign investment in power device manufacturing, leading to increased demand for advanced packaging solutions.

North America

- The U.S. Department of Energy has launched initiatives to promote the development of advanced packaging materials that enhance energy efficiency in power devices, encouraging collaboration between industry and academia.

- Companies like Texas Instruments and ON Semiconductor are leading the charge in developing innovative packaging solutions that reduce thermal resistance and improve performance, which is crucial for the growing electric vehicle market.

Middle East And Africa

- The UAE's Vision 2021 is promoting the adoption of smart technologies, which includes investments in power device packaging to support renewable energy initiatives.

- South Africa is seeing growth in local startups focused on innovative packaging solutions for power devices, driven by a need for energy-efficient technologies in the region.

Did You Know?

“Did you know that the efficiency of power devices can be significantly improved by using advanced packaging materials, which can reduce thermal resistance by up to 30%?” — International Journal of Electronics

Segmental Market Size

The New Packages and Materials for Power Devices segment plays a crucial role in enhancing the efficiency and performance of power electronics, currently experiencing stable growth. Key drivers include the increasing demand for energy-efficient solutions and advancements in semiconductor technologies, which necessitate innovative packaging materials that can withstand higher temperatures and improve thermal management. Regulatory policies promoting energy efficiency and sustainability further bolster this demand. Currently, the segment is in the scaled deployment stage, with companies like Infineon Technologies and Texas Instruments leading the charge in adopting advanced packaging solutions. Primary applications include electric vehicles, renewable energy systems, and consumer electronics, where efficient power management is critical. Trends such as the global push for decarbonization and the rise of electric mobility are accelerating growth, while technologies like silicon carbide (SiC) and gallium nitride (GaN) are shaping the evolution of packaging materials, enabling higher performance and reliability in power devices.

Future Outlook

The market for New Packages and Materials for Power Devices is poised for significant growth from 2025 to 2035, with a projected market value increase from $3.26 billion to $6.78 billion, reflecting a robust compound annual growth rate (CAGR) of 9.44%. This growth trajectory is primarily driven by the escalating demand for energy-efficient power devices across various sectors, including automotive, consumer electronics, and renewable energy. As industries increasingly prioritize sustainability and efficiency, the adoption of advanced packaging technologies and materials that enhance thermal management and reduce energy loss will become critical. By 2035, it is anticipated that the penetration of these new materials in power devices will reach approximately 30% of the overall market, underscoring their importance in future applications. Key technological advancements, such as the development of wide bandgap semiconductors and innovative packaging solutions, will further propel market expansion. These technologies not only improve performance but also enable miniaturization and integration of power devices, catering to the growing trend of compact and efficient electronic systems. Additionally, supportive government policies aimed at promoting clean energy and reducing carbon footprints will likely accelerate the adoption of these new materials. As a result, stakeholders in the power device market must remain agile and responsive to these emerging trends to capitalize on the opportunities presented in this evolving landscape.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 2.3 Billion |

| Market Size Value In 2023 | USD 2.5 Billion |

| Growth Rate | 15% (2023-2032 |

New Packages Materials Power Devices Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.