Expansion of Application Areas

The Neuromorphic Computing Market is expanding into diverse application areas, which is a key driver of its growth. From autonomous vehicles to smart cities, the versatility of neuromorphic systems is becoming increasingly apparent. These systems are capable of processing sensory data in real-time, making them ideal for applications that require immediate decision-making. The expansion into sectors such as healthcare, finance, and manufacturing is indicative of the technology's adaptability and potential. As organizations seek to leverage neuromorphic computing for enhanced operational efficiency and innovation, market analysts predict that the breadth of applications will continue to grow, further solidifying the industry's position in the broader technology landscape.

Increased Focus on Energy Efficiency

Energy efficiency is becoming a critical focus within the Neuromorphic Computing Market. As the demand for computing power escalates, the need for systems that consume less energy while delivering high performance is paramount. Neuromorphic computing offers a solution by mimicking the energy-efficient processes of the human brain. This focus on energy efficiency aligns with global sustainability goals, prompting organizations to seek out neuromorphic solutions that can reduce their carbon footprint. Market data indicates that energy-efficient computing solutions are expected to capture a larger market share, as companies prioritize sustainability alongside performance. This trend is likely to drive further innovation and adoption of neuromorphic technologies across various sectors.

Technological Advancements in Hardware

Technological advancements in hardware are propelling the Neuromorphic Computing Market forward. Innovations in chip design and materials science are enabling the development of neuromorphic chips that are not only more efficient but also capable of performing complex computations akin to human cognitive processes. These advancements are crucial as they allow for the creation of systems that can learn and adapt in real-time, which is essential for applications in robotics and AI. The market is witnessing significant investments in research and development, with projections indicating that the neuromorphic hardware segment could reach a valuation of several billion dollars by the end of the decade, underscoring the importance of these technological strides.

Growing Interest in Brain-Inspired Computing

The Neuromorphic Computing Market is witnessing a growing interest in brain-inspired computing paradigms. Researchers and developers are increasingly exploring how the human brain processes information, leading to the creation of systems that can replicate these processes. This interest is not merely academic; it has practical implications for industries such as healthcare, where neuromorphic systems can enhance diagnostic tools and patient monitoring. The potential for brain-inspired computing to revolutionize data processing and analysis is substantial, with market analysts suggesting that this segment could account for a significant share of the overall computing market in the near future. As more organizations recognize the benefits of these systems, investment and research in this area are likely to intensify.

Rising Demand for Advanced Computing Solutions

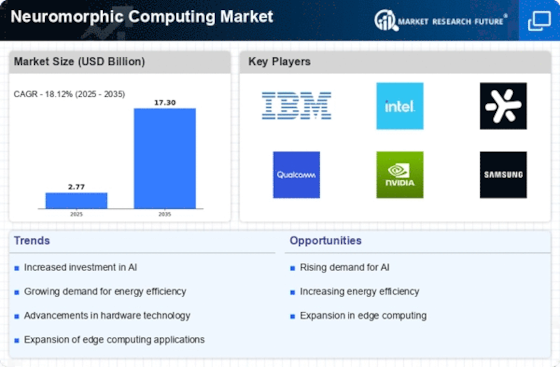

The Neuromorphic Computing Market is experiencing a surge in demand for advanced computing solutions that can efficiently process vast amounts of data. As industries increasingly rely on artificial intelligence and machine learning, the need for systems that mimic human brain functions becomes paramount. This demand is driven by the necessity for faster processing speeds and lower energy consumption. According to recent estimates, the neuromorphic computing sector is projected to grow at a compound annual growth rate of over 30% in the coming years. This growth reflects a broader trend towards integrating neuromorphic systems into various applications, including robotics, autonomous vehicles, and smart devices, thereby enhancing their capabilities and performance.