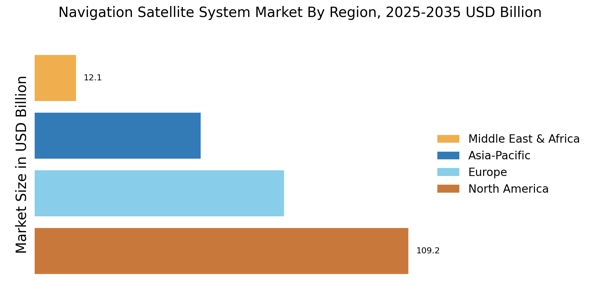

By Region, the study segments the market into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. Asia-Pacific dominated the Navigation Satellite System Market with a share of 36.2% of the total market in 2022. Asia-Pacific accounted for the largest share in the Navigation Satellite System Market due to the increasing adoption of smartphones wearable devices, and e-commerce. Moreover, the rising adoption of GNSS systems by the transportation companies in the region is also one of the major factors which are driving the market.

Advancements in technology, rising penetration of connected cars, increasing investments for surveillance by the governments in the region are also factors driving the market. Based on country, the region has been segmented into China, Japan, India, and the rest of Asia-Pacific. Increasing demand for wearable

GPS tracking devices

for tracking of humans and pets is driving the market growth. Moreover, various companies and individuals are using navigation systems for tracking of cargo trailers, personal vehicles, and construction assets. The growing demand for GNSS systems to track mining activities and oil & gas vehicles is also propelling the market growth in China. China is one of the largest manufacturers of automobiles across the globe and is integrating various navigation and tracking systems within these machines, which is driving the growth of the GNSS market across the country.

North America held the second-largest share in the GNSS market; this is due to the rapid advancements in technology, installation of connected devices, and increasing number of applications of GNSS in railways, transportation, and drone services, among others, which is leading the growth of the market. Additionally, the presence of various companies, such as Qualcomm Technologies and Trimble Inc., which are developing advance systems and components associated with GNSS, is also driving the market.

Europe holds the third-largest share and is expected to register significant growth in the GNSS market during the forecast period owing to the rising adoption of navigation systems across industries, including automotive and aerospace and defense. Galileo is the European global navigation satellite system that offers positioning, timing, and navigation data to the users across the Europe; this system provides improved positioning and timing information to the users. Increasing investments by companies and governments for monitoring the movements of vehicles and assets, among others, is also driving the market in the region.

Further, the countries considered in the scope of the Navigation Satellite System Market are the US, Canada, Mexico, UK, Germany, France, Italy, Spain, Switzerland, Austria, Belgium, Denmark, Finland, Greece, Hungary, Italy, Luxembourg, Netherlands, Norway, Poland, Portugal, Slovakia, Sweden, Romania, Ireland, China, Japan, Singapore, Malaysia, Indonesia, Philippines, South Korea, Hong Kong, Macau, Singapore, Brunei, India, Australia & New Zealand, South Africa, Egypt, Nigeria, Saudi Arabia, Qatar, United Arab Emirates, Bahrain, Kuwait, and Oman, Brazil, Argentina, Chile, and others.