Increased Focus on Cybersecurity

The US Flight Navigation System Market is increasingly prioritizing cybersecurity measures to protect navigation systems from potential threats. As aviation technology becomes more interconnected, the risk of cyberattacks on navigation systems has escalated. The FAA and other regulatory bodies are implementing stringent cybersecurity protocols to safeguard critical infrastructure. This focus on cybersecurity not only enhances the safety and reliability of navigation systems but also instills confidence among operators and passengers. As a result, investments in cybersecurity solutions are expected to rise, contributing to the overall growth of the market. The emphasis on secure navigation systems is likely to become a key differentiator for manufacturers in the competitive landscape.

Government Regulations and Policies

The US Flight Navigation System Market is heavily influenced by government regulations and policies aimed at enhancing aviation safety and efficiency. The FAA plays a crucial role in establishing standards for navigation systems, which ensures that all operators comply with the latest safety protocols. Recent initiatives, such as the Next Generation Air Transportation System (NextGen), aim to modernize the US airspace and improve navigation capabilities. This initiative is expected to lead to a more efficient air traffic management system, reducing delays and enhancing safety. The regulatory framework not only drives the adoption of advanced navigation technologies but also fosters a competitive environment among manufacturers, thereby stimulating market growth.

Emerging Trends in Sustainable Aviation

The US Flight Navigation System Market is increasingly aligning with emerging trends in sustainable aviation. As environmental concerns gain prominence, there is a growing emphasis on developing navigation systems that minimize fuel consumption and reduce emissions. Innovations such as optimized flight routing and advanced air traffic management systems are being explored to enhance operational efficiency. The FAA has initiated programs aimed at promoting sustainable practices within the aviation sector, which is expected to drive demand for eco-friendly navigation solutions. This shift towards sustainability not only addresses regulatory pressures but also appeals to environmentally conscious consumers, thereby creating new opportunities for growth in the market.

Technological Advancements in Navigation Systems

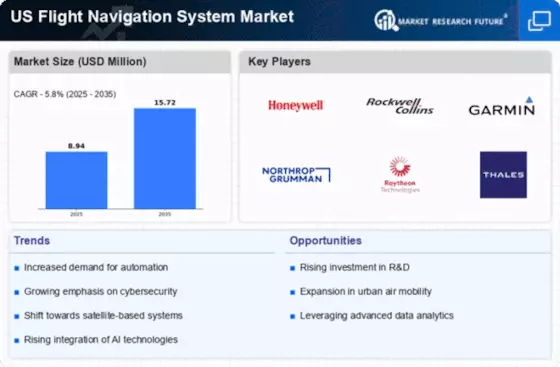

The US Flight Navigation System Market is experiencing a surge in technological advancements, particularly with the integration of satellite-based navigation systems. Innovations such as Automatic Dependent Surveillance-Broadcast (ADS-B) are enhancing situational awareness for pilots and air traffic controllers. The Federal Aviation Administration (FAA) has mandated the use of ADS-B by 2020, which has led to a significant increase in its adoption across the aviation sector. This shift not only improves safety but also optimizes air traffic management, thereby increasing efficiency in flight operations. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next five years, driven by these technological enhancements.

Growing Demand for Unmanned Aerial Vehicles (UAVs)

The US Flight Navigation System Market is witnessing a growing demand for Unmanned Aerial Vehicles (UAVs), which necessitates advanced navigation systems. As various sectors, including agriculture, logistics, and surveillance, increasingly adopt UAV technology, the need for reliable and precise navigation solutions becomes paramount. The FAA has been actively working on regulations to integrate UAVs into the national airspace, which is expected to further boost the market. By 2025, the UAV market is projected to reach USD 43 billion, indicating a substantial opportunity for navigation system providers. This trend highlights the importance of developing specialized navigation systems tailored for UAV applications, thereby driving innovation and growth in the industry.