Geopolitical Tensions

Geopolitical tensions are a driving force in the Naval Vessels and Surface Combatants Market, as nations seek to bolster their naval capabilities in response to regional conflicts and power dynamics. The ongoing territorial disputes in the South China Sea and the resurgence of naval posturing among major powers have led to increased investments in naval fleets. This environment fosters a competitive market, with countries striving to enhance their maritime strength. Analysts suggest that the demand for surface combatants will continue to rise, as nations prioritize deterrence and defense strategies. The market is likely to witness a shift towards more versatile and capable vessels, reflecting the changing nature of naval warfare.

Environmental Regulations

The Naval Vessels and Surface Combatants Market is increasingly influenced by environmental regulations aimed at reducing the ecological impact of naval operations. As governments implement stricter emissions standards and sustainability initiatives, shipbuilders are compelled to innovate and develop greener technologies. This shift may lead to the adoption of alternative fuels and energy-efficient designs, which could reshape the market landscape. The transition towards environmentally friendly vessels is not only a regulatory response but also a strategic move to enhance operational efficiency. The market may see a rise in demand for hybrid and electric propulsion systems, aligning with global efforts to promote sustainability in defense operations.

Increasing Defense Budgets

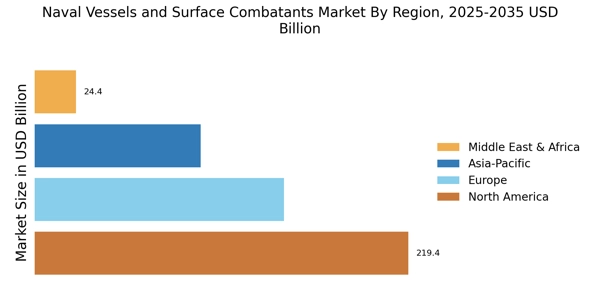

Rising defense budgets across various nations are significantly impacting the Naval Vessels and Surface Combatants Market. Countries are prioritizing naval capabilities to address emerging threats and enhance maritime security. For example, recent reports indicate that defense spending in Asia-Pacific is expected to increase by 5% annually, reflecting a strategic shift towards strengthening naval forces. This trend is likely to result in increased procurement of advanced surface combatants and support vessels. The emphasis on maintaining a robust naval presence is indicative of the geopolitical climate, where nations are investing heavily in their maritime domains to safeguard national interests and ensure regional stability.

Technological Advancements

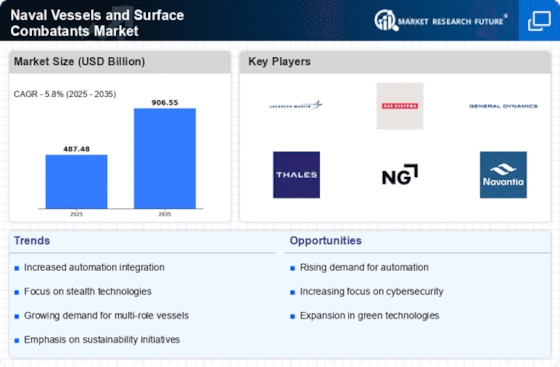

The Naval Vessels and Surface Combatants Market is experiencing a surge in technological advancements, particularly in areas such as automation, artificial intelligence, and advanced weaponry systems. These innovations are enhancing operational efficiency and combat capabilities. For instance, the integration of unmanned systems is expected to redefine naval warfare, allowing for more strategic deployments. The market is projected to grow at a compound annual growth rate of approximately 3.5% over the next five years, driven by the demand for modernized fleets equipped with cutting-edge technologies. As nations invest in research and development, the competitive landscape is likely to evolve, with emerging technologies playing a pivotal role in shaping future naval capabilities.

Strategic Alliances and Partnerships

Strategic alliances and partnerships are becoming increasingly prevalent in the Naval Vessels and Surface Combatants Market, as nations collaborate to enhance their naval capabilities. Joint ventures between countries and defense contractors facilitate knowledge sharing and resource pooling, leading to the development of advanced naval technologies. These collaborations are particularly evident in the context of multinational defense programs, where countries work together to design and produce next-generation vessels. Such partnerships not only reduce costs but also accelerate innovation, enabling nations to respond more effectively to emerging threats. The trend towards collaboration is likely to shape the future of naval procurement, fostering a more interconnected defense landscape.