Rising Geopolitical Tensions

The naval combat-vessels market is experiencing a surge in demand due to rising geopolitical tensions. Nations are increasingly investing in their naval capabilities to assert dominance and protect their interests. This trend is particularly evident in the US, where defense spending has seen a notable increase. In 2025, the US defense budget allocated approximately $800 billion, with a significant portion directed towards naval modernization. The focus on enhancing naval fleets, including aircraft carriers and destroyers, indicates a strategic shift towards maintaining maritime superiority. As countries perceive threats from rival nations, the naval combat-vessels market is likely to expand, driven by the need for advanced vessels equipped with cutting-edge technology.

Increased Focus on Maritime Security

The naval combat-vessels market is significantly influenced by the growing emphasis on maritime security. With the rise in piracy, smuggling, and territorial disputes, nations are prioritizing the protection of their maritime interests. The US has recognized the importance of securing its coastlines and trade routes, leading to increased investments in naval assets. In 2025, the US Coast Guard's budget reached $13 billion, reflecting a commitment to enhancing maritime security capabilities. This focus on safeguarding national waters is likely to drive demand for advanced naval combat vessels, as countries seek to bolster their fleets to address emerging threats.

Strategic Partnerships and Alliances

Strategic partnerships and alliances are playing a crucial role in shaping the naval combat-vessels market. Collaborative efforts between nations, particularly in defense procurement and technology sharing, are becoming more prevalent. The US has engaged in various defense agreements with allied nations, facilitating joint development programs for naval vessels. These partnerships not only enhance interoperability but also lead to cost-sharing in research and development. As countries recognize the benefits of collaboration, the naval combat-vessels market is expected to witness growth, driven by the collective pursuit of advanced naval capabilities.

Technological Integration in Naval Warfare

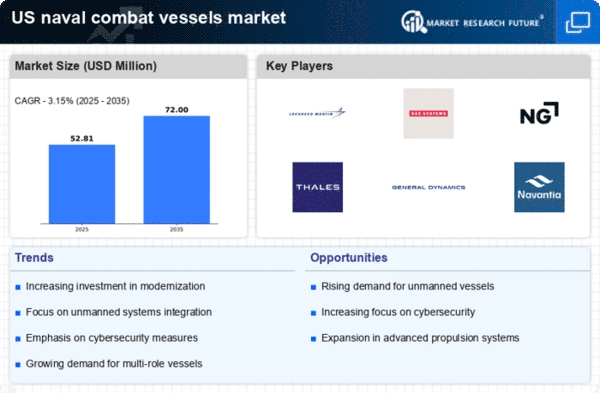

The integration of advanced technologies into naval combat vessels is reshaping the naval combat-vessels market. Innovations such as artificial intelligence, autonomous systems, and advanced weaponry are becoming essential components of modern naval fleets. The US Navy is actively pursuing initiatives to incorporate these technologies, aiming to enhance operational efficiency and combat readiness. For instance, the development of unmanned surface vessels is expected to revolutionize naval operations, allowing for more versatile and cost-effective missions. As these technologies evolve, the naval combat-vessels market is poised for growth, with manufacturers focusing on delivering vessels that meet the demands of modern warfare.

Environmental Regulations and Sustainability Initiatives

The naval combat-vessels market is increasingly impacted by environmental regulations and sustainability initiatives. As concerns over climate change and environmental degradation grow, governments are compelled to adopt greener practices in defense operations. The US Navy has set ambitious goals to reduce its carbon footprint, aiming for a 50% reduction in greenhouse gas emissions by 2030. This shift towards sustainability is prompting manufacturers to develop eco-friendly vessels, incorporating alternative fuels and energy-efficient technologies. Consequently, the naval combat-vessels market is likely to evolve, with a focus on producing vessels that align with environmental standards while maintaining operational effectiveness.