Market Trends

Key Emerging Trends in the Natural Organic Cosmetics Market

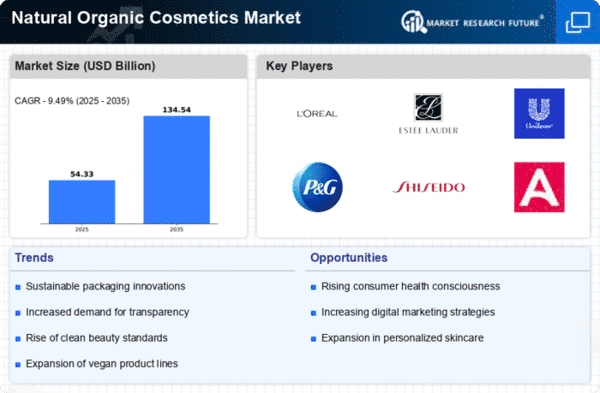

The market's landscape has witnessed a seismic shift owing to the escalating demand for natural and organic ingredients in cosmetics among consumers. A profound surge in health consciousness among global consumers has led to an increased preference for natural and organic beauty products. This growing inclination towards natural and organic cosmetics devoid of potentially harmful synthetic elements has emerged from rising concerns regarding beauty-related issues such as skin rashes, allergies, hair loss, acne, and dark spots. Consumers' interests are now leaning towards cosmetics incorporating natural oils, plant extracts, and other organic materials, fostering the creation of organic skincare products. Renowned beauty formulations integrate various natural components like olive oil, jojoba oil, argan oil, aloe vera, turmeric, and sunflower oil to cater to these escalating demands. This escalating demand stems from growing apprehensions about skin-related issues experienced globally, prompting clients to seek efficient and all-natural solutions. For instance, in 2018, the UK's natural and organic cosmetics market was estimated to be approximately valued at USD 96.91 million by the SOIL Association, further propelling manufacturers to emphasize the production of natural and organic cosmetics. Notably, major players in the industry have made strategic moves by acquiring startups specializing in organic and natural cosmetics. A prime example of this trend is L'Oreal's acquisition of Pulp Riot Hair, a step that is poised to influence the trajectory of the global market during the forecast period.

The inclination towards self-care and grooming has gained substantial momentum worldwide in recent years, notably propelled by women's increasing interest in the natural and organic cosmetics market. As daily schedules become more hectic, routines evolve, dietary habits shift, and sleep cycles vary, concerns regarding body and overall well-being are witnessing a steady rise. The use of beauty products to enhance the quality, cleanliness, and aesthetic appeal of external body parts has gained traction among people of all age groups.

Leave a Comment