Top Industry Leaders in the MRAM Market

Competitive Landscape of the MRAM Market:

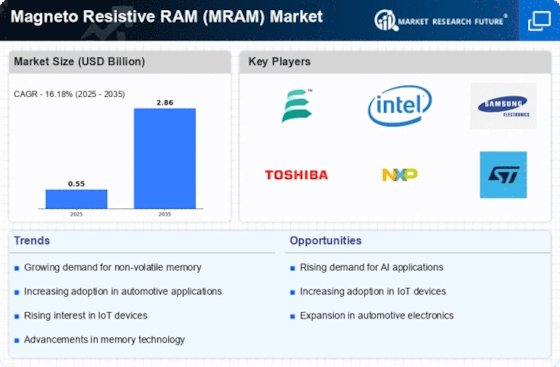

The Magneto-resistive RAM (MRAM) market is experiencing a dynamic evolution. This nascent technology, poised to disrupt the memory landscape with its unique blend of speed, endurance, and non-volatility, attracts a diverse range of players vying for dominance. Understanding the competitive landscape becomes crucial for navigating this exciting market.

Some of the Magneto Resistive RAM (MRAM) companies listed below:

- Toshiba Corporation (Japan)

- NVE Corporation (US)

- Everspin Technologies Inc. (US)

- Avalanche Technology Inc. (US)

- Spin Memory

- Inc. (US)

- Honeywell International Inc. (US)

- Samsung Electronics Co. Ltd (South Korea)

- Numem Inc. (US)

- Taiwan Semiconductor Manufacturing Company Limited (Taiwan)

Strategies Adopted by Key Players:

- Tech Giants: Samsung, Intel, and TSMC, leveraging their existing chip manufacturing prowess and vast R&D resources, are actively developing and commercializing MRAM solutions. Samsung's focus on high-density STT-MRAM caters to the consumer electronics and automotive sectors, while Intel targets enterprise storage and industrial applications. TSMC, meanwhile, adopts a foundry model, offering manufacturing services to other MRAM players.

- Traditional Memory Players: Micron Technology and SK Hynix, traditionally focused on DRAM and NAND, are also entering the MRAM fray. Micron's acquisition of Entropic Systems in 2022 bolsters its MRAM capabilities, while SK Hynix invests heavily in R&D for next-generation MRAM technologies.

- Specialty MRAM Companies: Everspin Technologies and Avalanche Technology are pioneers in the MRAM space, holding significant IP and expertise. Everspin focuses on embedded MRAM for industrial applications, while Avalanche Technology targets high-performance aerospace and defense markets.

Factors Shaping Market Share Analysis:

- Technology Roadmap: Different MRAM technologies, like Toggle MRAM and STT-MRAM, offer varied performance and cost characteristics. Players with a clear roadmap for scaling up production and cost reduction will be well-positioned to capture market share.

- Application Focus: MRAM caters to diverse applications, each with unique requirements. Targeting specific sectors like automotive, industrial automation, or medical devices with tailored solutions can provide a competitive edge.

- Regional Dynamics: The MRAM market is expected to see significant growth in Asia-Pacific, driven by strong demand from consumer electronics and automotive sectors. Companies with a robust presence and partnerships in these regions will benefit.

- Collaboration and Partnerships: Forming strategic partnerships with research institutions, material suppliers, and fabless design houses can accelerate technology development and market access, boosting market share.

New and Emerging Players:

- Start-ups: Companies like Spin Transfer Technologies and Crocus Nanoelectronics are emerging with innovative MRAM technologies, challenging established players. Their focus on niche applications and lower cost solutions can disrupt the market.

- Academia and Research Institutions: Universities and research labs play a crucial role in pushing the boundaries of MRAM technology. Their collaboration with industry players can lead to breakthroughs and new market entrants.

Latest Company Updates:

Oct. 17, 2023- Everspin Technologies, Inc., a leading global developer and manufacturer of MRAM persistent memory solutions, announced the expansion of its STT-MRAM product family, the EMxxLX. Product equipped with additional 4Mb capacity, smaller footprint package, and extended industrial temperature range of 105⁰C.

Oct. 25, 2022- Avalanche Technology, a leading provider of next-generation MRAM technology, announced signing a representation agreement with TMS-Elektronik for the sales and support of its STT-MRAM Products in Turkey. Under this agreement, Avalanche joined the TMS-Elektronik team at the SAHA Expo 2022 in Istanbul, held from Oct. 25-28th.

Oct. 19, 2022- Everspin Technologies, Inc., a leading global developer & manufacturer of MRAM persistent memory solutions, announced signing a contract with QuickLogic Corporation to provide MRAM technology, design, and manufacturing services. The initial award worth is US$2.8M, potentially increasing to US$8.7M with subsequent options.

Jan.12, 2022- Samsung Electronics, a global leader in advanced semiconductor technology, demonstrated the world's first MRAM-based in-memory computing. In standard computer architectures, data is stored in memory chips, while data computing is executed in separate processor chips.

Sep.27 2021- Avalanche Technology, a leading provider of next-generation MRAM technology, introduced new 64Mb STT-MRAM memory devices for industrial applications. The new 64Mb parallel x16 industrial P-SRAM products are the low-power, smallest form factor non-volatile memory devices available in the market, offering high reliability.

With this new product release, Avalanche brought high-reliability industrial products with the smallest form factor and lowest power, enabling customers to design unified memory architecture systems for industrial data logging applications.