Expansion of Mobile Devices and IoT

The proliferation of mobile devices and the Internet of Things (IoT) plays a crucial role in shaping the Dynamic RAM (DRAM) Industry. As more devices become interconnected, the demand for efficient memory solutions increases. Mobile devices, including smartphones and tablets, require high-density DRAM Market to support advanced functionalities and applications. Furthermore, IoT devices, which often operate in real-time, necessitate reliable and fast memory solutions to process data effectively. The market for DRAM Market in mobile applications is projected to grow at a rate of approximately 6% annually, indicating a strong correlation between the expansion of mobile technology and the demand for DRAM Industry.

Growth in Gaming and Virtual Reality

The gaming industry, particularly with the rise of virtual reality (VR) and augmented reality (AR), significantly influences the Dynamic RAM (DRAM) Market. Gamers increasingly demand high-quality graphics and seamless performance, which necessitates advanced memory solutions. DRAM Market is essential for rendering high-resolution graphics and ensuring smooth gameplay experiences. The gaming sector is expected to contribute substantially to the DRAM Market, with projections suggesting a growth rate of around 7% over the next few years. This trend highlights the importance of DRAM Market in meeting the performance expectations of modern gaming and immersive experiences.

Advancements in Automotive Technology

The automotive sector's transformation towards electric and autonomous vehicles is reshaping the Dynamic RAM (DRAM) Market. As vehicles become more technologically advanced, the need for sophisticated memory solutions increases. DRAM Market is critical for various applications, including advanced driver-assistance systems (ADAS), infotainment systems, and vehicle-to-everything (V2X) communication. The automotive DRAM Market is anticipated to grow at a compound annual growth rate of approximately 8%, driven by the integration of smart technologies in vehicles. This growth underscores the pivotal role of DRAM Market in supporting the automotive industry's evolution.

Rising Demand for High-Performance Computing

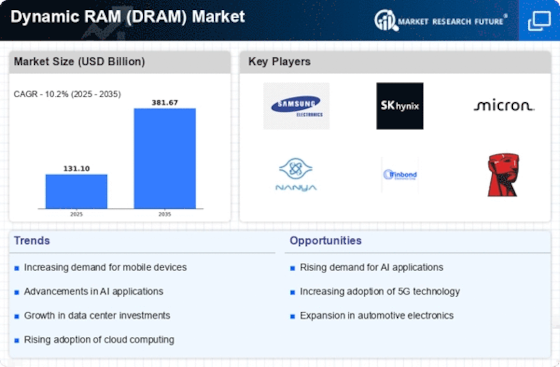

The Dynamic RAM (DRAM) Industryexperiences a notable surge in demand driven by the increasing need for high-performance computing solutions. Industries such as artificial intelligence, machine learning, and data analytics require advanced memory solutions to process vast amounts of data efficiently. As organizations seek to enhance their computational capabilities, the demand for DRAM Market is projected to grow significantly. According to recent estimates, the DRAM Market is expected to reach a valuation of approximately 100 billion dollars by 2026, reflecting a compound annual growth rate of around 5%. This trend indicates a robust market environment where DRAM Industrymanufacturers are likely to invest in innovative technologies to meet the evolving needs of high-performance applications.

Increased Focus on Data Centers and Cloud Computing

The rising emphasis on data centers and cloud computing services significantly impacts the DRAM Market. As businesses increasingly migrate to cloud-based solutions, the demand for high-capacity and high-speed memory solutions escalates. Data centers require substantial amounts of DRAM Market to manage workloads efficiently and ensure optimal performance. The market for DRAM Market in data centers is projected to grow at a rate of around 9% annually, reflecting the critical role of memory solutions in supporting the infrastructure of cloud services. This trend indicates a robust future for DRAM Market as it becomes integral to the backbone of modern computing.