Top Industry Leaders in the Monochloroacetic Acid Market

Monochloroacetic Acid Market

Monochloroacetic acid (MCAA), a versatile organic compound, boasts a dynamic and competitive market landscape. Understanding this landscape requires delving into the strategies employed by key players, the factors influencing market share, industry news, and recent developments. Let's dissect this complex space, unveiling its intricacies and potential future trajectories.

Strategies for Market Dominance:

1. Product Diversification: Leading players like Solvay, Akzo Nobel, and CABB are expanding their offerings beyond traditional MCAA forms (crystalline, liquid, flakes) to cater to niche applications. This includes high-purity grades for pharmaceuticals and specialty chemicals, solidifying their presence in lucrative segments.

2. Geographical Expansion: With Asia-Pacific dominating the market (39.2% share in 2022), companies are actively targeting emerging economies like India and China. This involves establishing local production facilities, forging strategic partnerships, and tailoring product offerings to regional needs.

3. Technological Innovation: Continuous research and development are crucial for staying ahead. Companies like Niacet and Denak are investing in green technologies for MCAA production, aiming to reduce environmental impact and capitalize on growing sustainability concerns.

4. Vertical Integration: Some players are consolidating their positions by integrating upstream (chlorine production) and downstream (derivatives manufacturing) activities. This enhances control over supply chains and optimizes costs, providing a competitive edge.

5. M&A Activity: Mergers and acquisitions are shaping the market. For instance, Solvay's acquisition of Cytec Industries in 2015 strengthened its position in the specialty chemicals segment, including MCAA.

Factors Influencing Market Share:

1. Demand: The diverse applications of MCAA, from agrochemicals and pharmaceuticals to textiles and personal care, drive demand. Growing populations and rising disposable incomes in developing economies are expected to further fuel this growth.

2. Raw Material Costs: Chlorine, the primary feedstock for MCAA, is subject to price fluctuations due to energy costs and environmental regulations. These fluctuations can impact production costs and profitability for market players.

3. Regulations: Stringent environmental regulations, particularly in Europe and North America, are pushing companies towards cleaner production processes and greener alternatives. This presents both challenges and opportunities for innovation.

4. Substitutes: Although MCAA has unique properties, competition from alternative chemicals like dichloroacetic acid and glycolic acid can impact market share in certain applications.

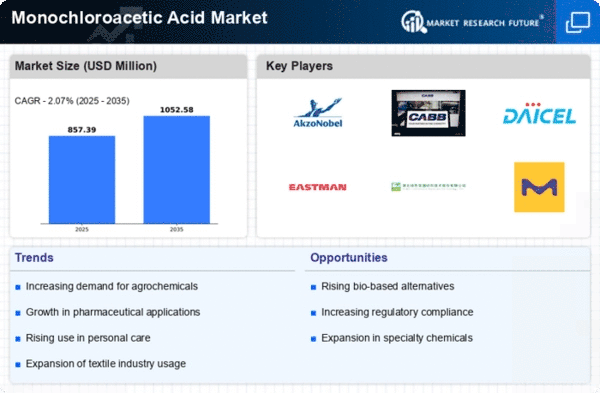

Key Companies in the Monochloroacetic Acid market include

- Akzo Nobel N.V. (Netherlands)

- CABB GmbH (Germany)

- Daicel Corporation (Japan)

- Denak Co. Ltd (Japan)

- The Dow Chemical Company (U.S.)

- PCC SE (Germany)

- Niacet (U.S.)

- Xuchang Dongfang Chemical Co. Ltd. (China)

- Shandong Minji Chemical Co. Ltd. (China)

- Shiv Chem Industries (India)

- Abhishek Impex (India)

- Merck KGaA (Germany)

- Jubilant Life Sciences Ltd. (India)

- Alfa Aesar

- Thermo Fisher Scientific (U.S.)

- anugrah IN-ORG(P) LIMITED (India)

Recent Developments:

November 20, 2023: Niacet Corporation intends to spend $25m on adding another facility for making monochloroacetic acid in the US. The proposed expansion would boost output by nearly a third because of higher consumption rates mainly driven through food processing sectors alongside side drug manufacturing industry.

BASF SE joined forces with RiKarbon last September (2022) so as not only to speed up business involving personal care formulations but also to develop new green emollients derived from bio-waste materials. BASF aims to use its wide range of customer contacts together with the ability to produce large quantities across different plants worldwide, thereby popularizing this technology while bringing about innovations within the beauty care segment.

September 2021: Archit Organosys' board approved increasing capacity by another twelve thousand metric tons annually (TPA) at the Bhavnagar site situated within Gujarat state; project cost estimated around INR five crores funded entirely via internal accruals since Monochloro Acetic Acid (MCA) demand has been growing rapidly locally and internationally as well, according to the management statement.