Market Share

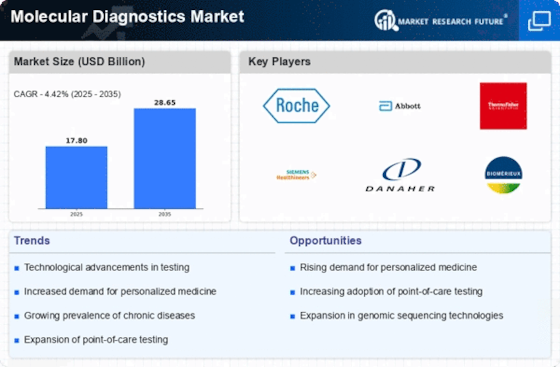

Molecular Diagnostics Market Share Analysis

The global molecular diagnostics market encompasses various diagnostic techniques, including polymerase chain reaction (PCR), next-generation sequencing (NGS), microarray, fluorescent in situ hybridization (FISH), and others. These techniques serve as key tools for diagnosing diseases, with the market further categorized based on the specific diseases targeted. Major disease segments include cancer, infectious diseases, HIV and STDs, as well as women's health issues such as breast cancer, cervical cancer, ovarian cancer, and vaginitis.

Among these, molecular diagnostics tests find extensive application in the diagnosis of blood cancer, often leveraging the PCR technique for precise and reliable results. Given the global impact of cancer, which stands as the leading cause of death, the significance of molecular diagnostics becomes paramount. According to the World Health Organization (WHO), approximately 9.6 million deaths were attributed to cancer globally in 2018, with 70% of these occurring in low- and middle-income countries.

The increasing prevalence of various types of cancer worldwide underscores the growing demand for diagnostics, reflecting the critical role molecular diagnostics plays in disease detection and management. As cancer rates continue to rise, the demand for molecular diagnostics is expected to follow suit, addressing the pressing need for accurate and timely diagnostic solutions.

The untapped potential of developing economies presents significant opportunities for various markets, particularly in the context of their underdeveloped research and development sectors, which struggle to address emerging health challenges. Africa, in particular, stands out as an example where there is a substantial demand for medical solutions, including medicines and health technologies. However, the region faces challenges as it is heavily reliant on imported healthcare products.

Despite a high demand for medical treatment, the slow growth of the healthcare industry in Africa is impeded by poor economic conditions. The region grapples with economic challenges that hinder the development of robust healthcare infrastructure. For instance, statistics from the National Centre for Biotechnology Information (NCBI) in 2016 reveal that approximately 180 patients at the West China Hospital were diagnosed with infectious diseases through molecular diagnostics.

The significant population affected by chronic diseases in these developing countries presents a substantial opportunity for key players in the molecular diagnostics market. These regions, facing healthcare challenges, require molecular diagnostic tests for accurate diagnosis and effective treatment. Thus, the molecular diagnostics market can play a vital role in addressing health needs and improving healthcare outcomes in developing economies with substantial unmet medical demands.

Leave a Comment