Market Analysis

In-depth Analysis of Molecular Diagnostics Market Industry Landscape

In recent years, next-generation sequencing (NGS) technology has been gradually supplanting first-generation sequencing, evolving into a molecular microscope with broad applications in the study of bacterial genomes. Widely utilized in clinical microbiology, NGS offers an expansive investigation into the genomic characteristics of pathogens. Introduced to the market in 2005, NGS is favored in laboratories for internal genome sequencing projects due to its cost-effectiveness and the requirement for smaller DNA amounts, ensuring accurate and reliable data. Notably, this technology excels in producing high-quality results, but its success depends on the expertise to analyze and interpret the data.

In microbial identification, there is a notable trend shifting from well-established analytical profile index (API) methods to mass spectrometry (MS)-based methodologies, focusing on microbial, physiological, or biochemical characteristics, including antibiotic resistance. Challenges persist in enriching bacterial cells and metabolites for biomarker detection. A combination of genetic and non-genetic methods, such as PCR-MS for determining nucleotide compositions of strain-specific PCR products, has emerged.

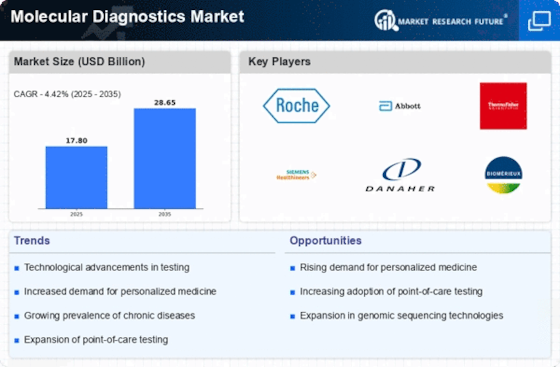

Ongoing research in both genotypic and phenotypic methodologies is anticipated to contribute to the development of diagnostics that are rapid, specific, sensitive, easy to perform and interpret, cost-effective, and high throughput. The increasing prevalence of various infectious and chronic diseases has spurred a demand for new molecular diagnostic tests, prompting companies to invest in research and development to introduce innovative diagnostic solutions to the market.

The research and development phase in molecular diagnostics services focuses on enhancing and creating innovative solutions to improve the efficacy and uniqueness of these services. Given the limited availability of services in the molecular diagnostics sector, companies are actively engaged in innovating their offerings to cater to a variety of applications. This intricate process involves intensive brainstorming and demands in-depth knowledge and efficiency. Molecular diagnostic tests, like the polymerase chain reaction, are specifically crafted to lower costs for companies involved in the development of new therapies and drugs within niche markets. Through this value chain analysis process, the highest value is delivered to the entire chain, ensuring a continuous enhancement of molecular diagnostics services.

Leave a Comment