Mobile Gambling Size

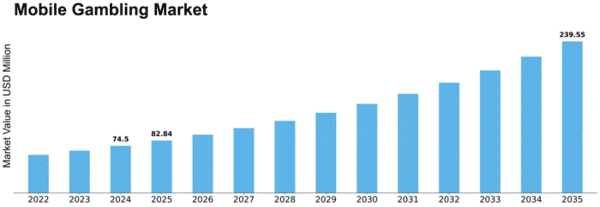

Mobile Gambling Market Growth Projections and Opportunities

Mobile gambling refers to the act of betting or gaming through mobile devices such as phones, smartphones, or tablets. Players typically download an application and engage in gaming activities using an active internet connection. The mobile gambling market is anticipated to experience substantial growth, as per the analysis conducted by MRFR. This growth is propelled by the increasing interest in mobile gaming among the younger demographic and the legalization of online gambling in numerous countries. However, a significant challenge remains in the form of security risks, including cyberattacks, posing concerns for both gamblers and operators alike.

The MRFR analysis segments the mobile gambling market based on type, end user, and geographical regions. In terms of type, the market comprises categories like betting, casino games, poker, lottery, online bingo, and others. The casino gaming segment notably held the largest market share in 2018, while the poker segment is anticipated to witness the highest Compound Annual Growth Rate (CAGR) during the forecast period. Categorizing by end user, the market is divided into gambling enthusiasts, social exuberants, and dabblers. In 2018, gambling enthusiasts accounted for the highest market share, whereas the social exuberant segment is predicted to experience the most rapid growth during the forecast period.

Geographically, the global mobile gambling market is divided into four key regions: North America, Europe, Asia-Pacific, and the rest of the world. Europe emerged as the leader in the mobile gambling market in 2018, capturing a significant share of 57.20%. Conversely, the Asia-Pacific region is expected to witness the most accelerated growth in the mobile gambling sector, projected to achieve the highest Compound Annual Growth Rate (CAGR) of 13.8% during the forecast period.

Mobile gambling involves wagering or playing games through mobile devices like phones, smartphones, or tablets. It's a market that's expected to grow significantly, driven by the rising interest in mobile gaming among the younger generation and the legalization of online gambling in various countries. However, security threats, particularly cyberattacks, pose a significant challenge for both players and operators.

The market analysis by MRFR divides the mobile gambling sector based on type, end users, and geographical regions. Types of mobile gambling include betting, casino games, poker, lottery, online bingo, and other gaming options. The casino gaming segment dominated the market in 2018, but poker is predicted to experience the most rapid growth in the coming years. In terms of end users, there are categories like gambling enthusiasts, social exuberants, and dabblers. Gambling enthusiasts had the largest market share in 2018, while the social exuberant segment is anticipated to grow the fastest.

Geographically, the global mobile gambling market is segmented into North America, Europe, Asia-Pacific, and the rest of the world. Europe took the lead in 2018, capturing a substantial 57.20% market share. However, the Asia-Pacific region is set to undergo the most significant growth, projected to achieve a remarkable Compound Annual Growth Rate (CAGR) of 13.8% during the forecast period.

Mobile gambling refers to the act of betting or gaming through mobile devices such as phones, smartphones, or tablets. Players typically download an application and engage in gaming activities using an active internet connection. The mobile gambling market is anticipated to experience substantial growth, as per the analysis conducted by MRFR. This growth is propelled by the increasing interest in mobile gaming among the younger demographic and the legalization of online gambling in numerous countries. However, a significant challenge remains in the form of security risks, including cyberattacks, posing concerns for both gamblers and operators alike.

The MRFR analysis segments the mobile gambling market based on type, end user, and geographical regions. In terms of type, the market comprises categories like betting, casino games, poker, lottery, online bingo, and others. The casino gaming segment notably held the largest market share in 2018, while the poker segment is anticipated to witness the highest Compound Annual Growth Rate (CAGR) during the forecast period. Categorizing by end user, the market is divided into gambling enthusiasts, social exuberants, and dabblers. In 2018, gambling enthusiasts accounted for the highest market share, whereas the social exuberant segment is predicted to experience the most rapid growth during the forecast period.

Geographically, the global mobile gambling market is divided into four key regions: North America, Europe, Asia-Pacific, and the rest of the world. Europe emerged as the leader in the mobile gambling market in 2018, capturing a significant share of 57.20%. Conversely, the Asia-Pacific region is expected to witness the most accelerated growth in the mobile gambling sector, projected to achieve the highest Compound Annual Growth Rate (CAGR) of 13.8% during the forecast period.

Mobile gambling involves wagering or playing games through mobile devices like phones, smartphones, or tablets. It's a market that's expected to grow significantly, driven by the rising interest in mobile gaming among the younger generation and the legalization of online gambling in various countries. However, security threats, particularly cyberattacks, pose a significant challenge for both players and operators.

The market analysis by MRFR divides the mobile gambling sector based on type, end users, and geographical regions. Types of mobile gambling include betting, casino games, poker, lottery, online bingo, and other gaming options. The casino gaming segment dominated the market in 2018, but poker is predicted to experience the most rapid growth in the coming years. In terms of end users, there are categories like gambling enthusiasts, social exuberants, and dabblers. Gambling enthusiasts had the largest market share in 2018, while the social exuberant segment is anticipated to grow the fastest.

Geographically, the global mobile gambling market is segmented into North America, Europe, Asia-Pacific, and the rest of the world. Europe took the lead in 2018, capturing a substanti

Leave a Comment