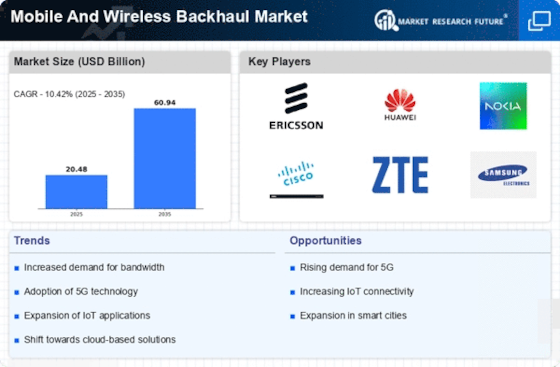

Expansion of 5G Networks

The rollout of 5G networks is significantly influencing the Mobile And Wireless Backhaul Market. As telecommunications companies invest heavily in 5G infrastructure, the need for efficient backhaul solutions becomes increasingly critical. 5G technology promises to deliver ultra-low latency and high-speed data transfer, which requires advanced backhaul systems to support the increased data load. Industry estimates suggest that by 2025, 5G networks could account for a substantial portion of mobile connections, further driving the demand for innovative backhaul solutions. This expansion not only enhances user experience but also opens new avenues for applications such as IoT and smart cities, thereby stimulating growth in the Mobile And Wireless Backhaul Market.

Increased Adoption of IoT Devices

The rapid adoption of Internet of Things (IoT) devices is emerging as a significant driver for the Mobile And Wireless Backhaul Market. As more devices become interconnected, the volume of data generated necessitates robust backhaul solutions to manage and transmit this information effectively. The proliferation of smart devices in various sectors, including healthcare, transportation, and manufacturing, is expected to contribute to a substantial increase in data traffic. Reports indicate that the number of connected IoT devices could reach over 30 billion by 2025, creating a pressing need for efficient backhaul systems. This trend underscores the critical role of the Mobile And Wireless Backhaul Market in supporting the infrastructure required for a connected world.

Rising Demand for High-Speed Connectivity

The increasing demand for high-speed internet connectivity is a primary driver of the Mobile And Wireless Backhaul Market. As consumers and businesses alike seek faster and more reliable internet services, telecommunications providers are compelled to enhance their backhaul infrastructure. This trend is particularly evident with the proliferation of data-intensive applications such as video streaming, online gaming, and cloud computing. According to recent data, the global demand for mobile data traffic is projected to grow exponentially, potentially reaching over 77 exabytes per month by 2025. This surge necessitates robust backhaul solutions to ensure seamless connectivity, thereby propelling the Mobile And Wireless Backhaul Market forward.

Growing Focus on Network Reliability and Resilience

The emphasis on network reliability and resilience is becoming increasingly prominent within the Mobile And Wireless Backhaul Market. As businesses and consumers rely more heavily on digital services, the need for uninterrupted connectivity has never been greater. This has led to investments in more resilient backhaul solutions that can withstand disruptions and ensure consistent service delivery. Telecommunications providers are exploring diverse technologies, including microwave and fiber-optic solutions, to enhance their backhaul networks. The market is likely to see a shift towards hybrid solutions that combine various technologies to optimize performance and reliability, thereby reinforcing the Mobile And Wireless Backhaul Market.

Regulatory Support for Telecommunications Infrastructure

Regulatory frameworks supporting telecommunications infrastructure development are playing a crucial role in shaping the Mobile And Wireless Backhaul Market. Governments are increasingly recognizing the importance of robust communication networks for economic growth and social development. As a result, many countries are implementing policies that facilitate the expansion of telecommunications infrastructure, including backhaul systems. This regulatory support may include funding initiatives, streamlined permitting processes, and incentives for private investment. Such measures are expected to accelerate the deployment of advanced backhaul solutions, thereby enhancing the overall capacity and efficiency of telecommunications networks. This trend is likely to have a lasting impact on the Mobile And Wireless Backhaul Market.