Emergence of 5G Technology

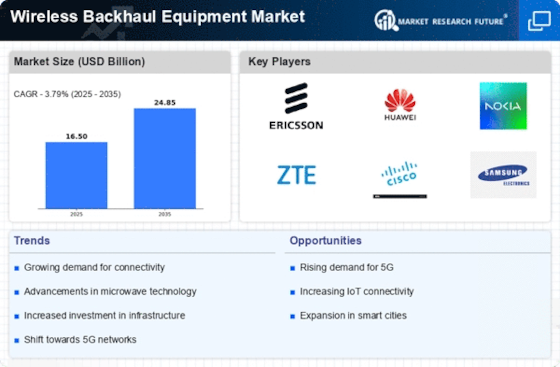

The Wireless Backhaul Equipment Market is significantly impacted by the emergence of 5G technology. The rollout of 5G networks is transforming the telecommunications landscape, offering unprecedented data speeds and connectivity options. As of 2025, it is estimated that 5G subscriptions will surpass 1 billion globally, creating an urgent need for advanced backhaul solutions to support this new technology. The high capacity and low latency requirements of 5G necessitate the deployment of sophisticated wireless backhaul systems that can handle increased data loads. This technological shift is prompting service providers to invest heavily in wireless backhaul equipment, as they seek to capitalize on the opportunities presented by 5G and meet the demands of a more connected society.

Growth of Cloud-Based Services

The Wireless Backhaul Equipment Market is being propelled by the growth of cloud-based services. As organizations increasingly migrate their operations to the cloud, the demand for efficient data transfer and connectivity solutions intensifies. In 2025, the cloud services market is projected to reach 832 billion dollars, necessitating the deployment of advanced backhaul systems to support the high data throughput required for cloud applications. This shift towards cloud computing is driving telecommunications providers to invest in wireless backhaul technologies that can accommodate the increased data traffic and ensure low-latency connections. Consequently, the expansion of cloud services is a key driver for the wireless backhaul equipment market, as it necessitates the development of scalable and efficient backhaul solutions.

Expansion of Smart City Initiatives

The Wireless Backhaul Equipment Market is significantly influenced by the expansion of smart city initiatives. Governments and municipalities are increasingly investing in smart infrastructure to enhance urban living, which includes the deployment of smart lighting, traffic management systems, and public safety networks. These initiatives require reliable and high-capacity backhaul solutions to connect various devices and systems. As of 2025, it is estimated that smart city investments will exceed 1 trillion dollars, creating a substantial market opportunity for wireless backhaul equipment. The integration of these technologies necessitates efficient data transmission, thereby driving the demand for advanced backhaul solutions that can support the growing number of connected devices.

Rising Demand for Enhanced Mobile Connectivity

The Wireless Backhaul Equipment Market is experiencing a surge in demand for enhanced mobile connectivity. As mobile data consumption continues to escalate, driven by the proliferation of smartphones and IoT devices, the need for robust backhaul solutions becomes increasingly critical. In 2025, mobile data traffic is projected to reach 77 exabytes per month, necessitating advanced backhaul systems to manage this influx. This demand is further fueled by the rollout of 5G networks, which require high-capacity backhaul links to support faster data rates and lower latency. Consequently, telecommunications providers are investing heavily in wireless backhaul technologies to ensure seamless connectivity and meet consumer expectations.

Increased Focus on Network Reliability and Resilience

The Wireless Backhaul Equipment Market is witnessing an increased focus on network reliability and resilience. As businesses and consumers alike demand uninterrupted connectivity, service providers are compelled to enhance their network infrastructures. The rise in cyber threats and natural disasters has further underscored the necessity for resilient backhaul systems that can maintain service continuity. In 2025, it is anticipated that investments in network resilience will account for a significant portion of telecommunications budgets, with many operators prioritizing wireless backhaul solutions that offer redundancy and failover capabilities. This trend indicates a shift towards more robust and reliable backhaul technologies, which are essential for maintaining service quality in an increasingly connected world.