Rising Demand for Minerals

The Mining Equipment Market is experiencing a notable surge in demand for minerals, driven by the increasing consumption of metals and minerals in various sectors. Industries such as construction, automotive, and electronics are expanding, leading to heightened requirements for raw materials. For instance, the demand for copper and lithium is projected to rise significantly due to their essential roles in renewable energy technologies and electric vehicles. This trend is likely to propel investments in mining operations, thereby stimulating the Mining Equipment Market. As companies seek to enhance their production capabilities, the need for advanced mining equipment becomes paramount, suggesting a robust growth trajectory for the industry.

Technological Advancements in Mining

Technological advancements are revolutionizing the Mining Equipment Market, enhancing efficiency and productivity. Innovations such as automation, artificial intelligence, and data analytics are being integrated into mining operations, leading to improved safety and reduced operational costs. For instance, the adoption of autonomous vehicles in mining sites is expected to increase operational efficiency by minimizing human error and optimizing resource allocation. As mining companies seek to leverage these technologies, the demand for advanced mining equipment is anticipated to rise. This trend indicates a shift towards more sophisticated and efficient mining practices, positioning the Mining Equipment Market for substantial growth.

Infrastructure Development Initiatives

Infrastructure development initiatives are playing a crucial role in shaping the Mining Equipment Market. Governments and private entities are increasingly investing in infrastructure projects, which necessitate substantial quantities of minerals and metals. For example, the construction of roads, bridges, and railways requires significant amounts of steel and concrete, both of which rely on mining activities. This growing focus on infrastructure is expected to drive demand for mining equipment, as companies strive to meet the rising needs of construction projects. The Mining Equipment Market is likely to benefit from these initiatives, as they create a favorable environment for mining operations and equipment procurement.

Environmental Regulations and Compliance

The Mining Equipment Market is increasingly influenced by stringent environmental regulations and compliance requirements. Governments are implementing policies aimed at reducing the environmental impact of mining activities, which necessitates the adoption of cleaner and more efficient technologies. Companies are compelled to invest in equipment that meets these regulatory standards, driving demand for innovative mining solutions. For example, equipment designed to minimize emissions and enhance energy efficiency is becoming essential for compliance. This shift towards sustainable practices is likely to reshape the Mining Equipment Market, as companies prioritize environmentally friendly technologies in their operations.

Emerging Markets and Investment Opportunities

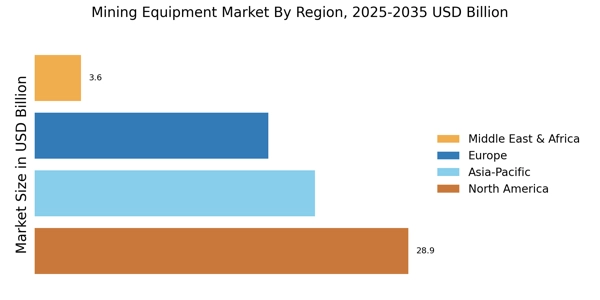

Emerging markets are presenting new investment opportunities within the Mining Equipment Market. Countries rich in natural resources are attracting foreign investments, as companies seek to capitalize on untapped mineral reserves. This trend is particularly evident in regions with abundant deposits of precious metals and minerals. As these markets develop, the demand for mining equipment is expected to rise, driven by the need for efficient extraction methods. Furthermore, the influx of investments is likely to stimulate local economies, creating a favorable environment for the Mining Equipment Market to flourish. This dynamic suggests a promising outlook for stakeholders in the mining sector.