Market Analysis

In-depth Analysis of Military UAV Sensor Market Industry Landscape

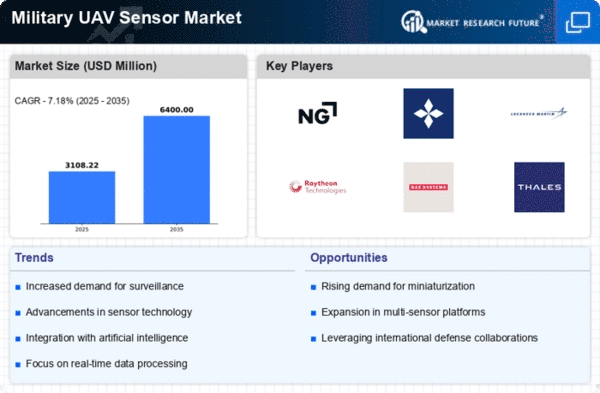

The development, advancement, and reception of military UAV sensors inside the safeguard area are significantly affected by a large number of market elements impacting factors. Mechanical headways are the overwhelming impetuses in this market. Sensor innovation for military automated airborne vehicles has been essentially changed by the consistent progressions in goal, reach, exactness, and mix capacities. Significant improvements in SAR, electro-optical (EO), and infrared (IR) sensors engage UAVs to all the more effectively perform observation, reconnaissance, and knowledge gathering, consequently impacting market elements as per advancing guard requests.

The ascent in accentuation on working on the capacities of observation and reconnaissance drives the requirement for military UAV sensors. Sensors of this nature are vital in outfitting military powers with situational mindfulness, continuous knowledge, and target procurement capacities. The market elements are affected by the ability of UAV sensors to gather information across broad districts, notice tasks, and recognize takes a chance in different geographies and environmental factors. This drives speculations and progress in sensor advancements that explicitly address the developing necessities of protection applications. Besides, market elements in the military UAV sensor area are significantly affected by the unique enhancements that happen in clashes, unbalanced fighting, and counterinsurgency tasks. Uncommon danger and hid target discovery, ID, and following capacities are fundamental for UAV sensors used by protection organizations. The consistently changing necessities of protection areas drive the requirement for sensors equipped for working effectively in many-sided and requesting environmental factors, in this manner affecting business sector elements through the advancement of more adaptable and particular sensor frameworks. Administrative norms and consistency commitments likewise significantly affect the market elements of military UAV sensors. Severe quality, security, and functional standards should be trailed by UAV sensors of military grade to ensure steadfastness, accuracy, and adherence to protection guidelines. By putting resources into consistency with these thorough guidelines, producers ensure that their sensors fulfill the prerequisites for protection contracts, in this manner applying an effect on market elements and acquisition choices. The impact of cost factors on market elements is critical in the military UAV sensor industry also. While chasing after financially savvy arrangements, safeguard organizations attempt to keep up with execution and quality principles. Upper hand is acquired by producers who intend to convey elite execution sensors at cutthroat costs. This effect on market elements is accomplished through the fascination of guard organizations that are looking for esteem driven arrangements. Likewise, tries dedicated to innovative work (Research and development) encourage seriousness and advancement on the lookout for military UAV sensors. Organizations keep an upper hand by putting resources into Research and development drives that upgrade sensor innovations, capacities, capacities joining, and cost decrease, as well as the combination of refined highlights. The ceaseless advancement in sensor scaling down, improved usefulness, information handling, and mix affects market elements as it pushes the development of UAV sensor frameworks that are more adaptable and productive. Mechanical progressions, the interest for further developed observation capacities, advancing guard particulars, administrative consistence, cost-adequacy, and ceaseless advancement all impact the market elements of military UAV sensors. Considering developing guard necessities that focus on precision, adaptability, and upgraded reconnaissance functionalities, the headway and execution of UAV sensor innovation will persevere as significant variables affecting business sector elements and embellishment the direction of military UAV sensor arrangements.

Leave a Comment