Top Industry Leaders in the Military UAV Sensor Market

The Military Unmanned Aerial Vehicle (UAV) Sensor Market stands at the forefront of modern defense capabilities, providing crucial intelligence, surveillance, and reconnaissance (ISR) capabilities to military forces globally. This comprehensive overview delves into the competitive landscape, covering key players, strategies, factors influencing market share, emerging companies, industry news, and investment trends that shape the overall competitive scenario.

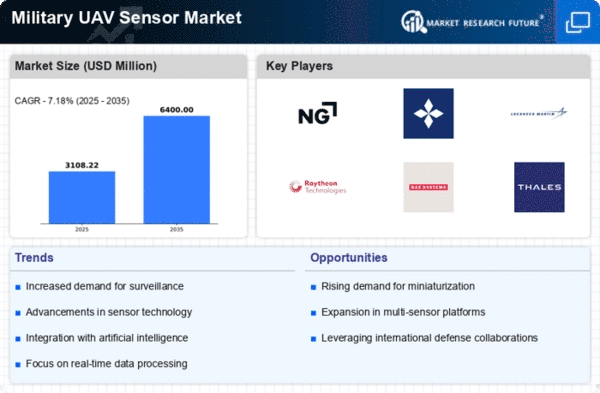

Key Players:

- TE Connectivity (Switzerland)

- Raytheon Company (US)

- Thales Group (France)

- Lockheed Martin (US)

- AeroVironment (US)

- General Atomics (US)

- FLIR Systems (US)

- Elbit Systems (Israel)

- Kratos Defense & Security Solutions (US)

- Northrop Grumman Corporation (US)

- Honeywell International Inc. (US)

- Safran Electronics & Defense (France)

Strategies Adopted:

Key players in the Military UAV Sensor Market deploy strategic initiatives to maintain and strengthen their market positions. Continuous investment in research and development is a common strategy, introducing innovative UAV sensor technologies, including high-resolution imaging sensors, multi-spectral sensors, and advanced signal processing capabilities. Moreover, strategic collaborations with UAV manufacturers, international partnerships, and military research institutions facilitate the development of tailored sensor solutions, ensuring UAVs are equipped with sensors that meet the evolving needs of modern military operations.

Factors for Market Share Analysis:

Market share analysis in the Military UAV Sensor Market is influenced by critical factors such as the performance and sensitivity of sensors, the ability to operate in various environmental conditions, and compliance with stringent military standards. Companies excelling in delivering UAV sensors with long-range detection, high-resolution imagery, and advanced target recognition capabilities are likely to secure a significant market share. The capacity to address the diverse requirements of different military UAV platforms, including fixed-wing, rotary-wing, and unmanned combat aerial vehicles (UCAVs), is crucial in determining market dominance.

New and Emerging Companies:

In the evolving landscape of the Military UAV Sensor Market, new and emerging companies are making strides. Entities such as Velodyne Lidar, Inc., Quanergy Systems, Inc., and Teledyne Technologies Incorporated bring innovative approaches to UAV sensor technologies, focusing on advancements in LiDAR (Light Detection and Ranging), hyperspectral imaging, and autonomous sensor systems. These companies contribute agility and niche expertise, challenging traditional approaches and introducing disruptive technologies that address specific challenges in modern military UAV applications.

Industry News:

Recent industry news underscores the dynamic nature of the Military UAV Sensor Market, with reports of successful UAV sensor deployments, partnerships between sensor manufacturers and defense agencies, and advancements in technologies such as real-time data fusion. Additionally, news regarding the integration of artificial intelligence for autonomous target recognition, the development of miniaturized sensor systems for micro UAVs, and international collaborations for joint UAV surveillance missions highlight the industry's commitment to staying at the forefront of evolving military requirements. Such developments contribute to the evolving landscape and indicate a shift towards more advanced and adaptable UAV sensor solutions.

Current Company Investment Trends:

Investments in the Military UAV Sensor Market reflect a commitment to advancing technology and addressing the evolving needs of modern military UAV operations. Key players are investing significantly in research and development to enhance the capabilities of UAV sensors, improve sensor technologies, and address emerging challenges such as countermeasures against sensor jamming. Strategic acquisitions and partnerships to expand solution portfolios, ensure interoperability, and address evolving military threats are common investment trends. Furthermore, advancements in artificial intelligence for sensor data analytics, the integration of sensors with other ISR capabilities, and the exploration of new materials for sensor development are notable focus areas, aiming to enhance the overall performance and versatility of UAV sensor solutions.

Overall Competitive Scenario:

The overall competitive scenario in the Military UAV Sensor Market is characterized by a blend of established players providing comprehensive solutions and innovative newcomers introducing disruptive technologies. As military UAVs continue to evolve as essential assets for ISR missions, the competition revolves around delivering sensor systems that offer not only cutting-edge technology but also adaptability to different mission profiles and environmental conditions. The ongoing advancements in multi-spectral imaging, LiDAR technologies, and the development of sensors for swarming UAVs further shape the competitive dynamics in the market.

Recent Developments:

January 2024:

Leonardo DRS (USA): Secured a USD 45 million contract from the US Navy for advanced radar and electro-optical (EO) sensors to be integrated into their MQ-25A Stingray unmanned refueling aircraft. The contract highlights the growing demand for multi-sensor payloads for enhanced situational awareness and target identification.

Thales Group (France): Successfully conducted flight tests of their Spy'Ranger tactical UAV equipped with new high-resolution LiDAR (Light Detection and Ranging) sensors. This technology offers detailed 3D mapping capabilities for terrain analysis and target identification in challenging environments.