Geopolitical Tensions

Geopolitical tensions are a significant driver of the Global Military Satellite Industry. Heightened conflicts and territorial disputes compel nations to bolster their military capabilities, particularly in satellite communications and surveillance. Countries such as China and Russia are investing heavily in their satellite systems to enhance their military readiness and intelligence-gathering capabilities. This trend is likely to stimulate demand for advanced military satellites, as nations seek to secure their interests and maintain situational awareness in an increasingly complex global landscape.

Increasing Defense Budgets

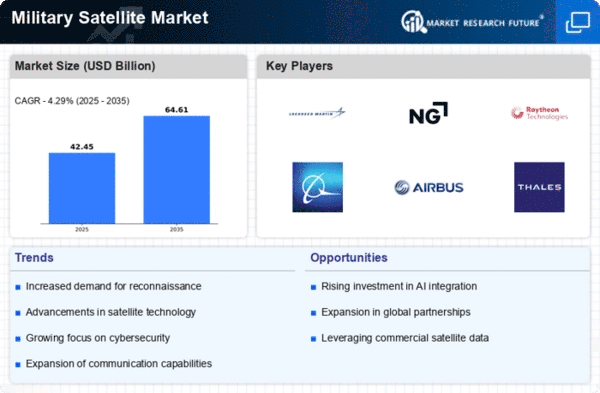

The Global Military Satellite Industry is experiencing growth due to rising defense budgets across various nations. Countries are prioritizing military modernization, which includes enhancing satellite capabilities for reconnaissance, communication, and navigation. For instance, the United States has allocated substantial funding towards satellite systems, reflecting a broader trend among NATO allies. As military expenditures increase, the Global Military Satellite Market is projected to reach 20.5 USD Billion in 2024, with expectations of further growth as nations invest in advanced technologies to maintain strategic advantages.

Technological Advancements

Technological advancements play a pivotal role in the Global Military Satellite Industry. Innovations in satellite design, miniaturization, and propulsion systems are enabling the deployment of more sophisticated satellites. Enhanced capabilities such as real-time data processing and improved imaging resolution are becoming standard. For example, the integration of artificial intelligence in satellite operations is streamlining data analysis and decision-making processes. As these technologies evolve, they are likely to drive market growth, contributing to an anticipated increase to 30 USD Billion by 2035, reflecting a compound annual growth rate of 3.54% from 2025 to 2035.

Public-Private Partnerships

Public-private partnerships are emerging as a vital driver within the Global Military Satellite Industry. Collaborative efforts between government entities and private aerospace companies are fostering innovation and reducing costs associated with satellite development and deployment. These partnerships enable the sharing of resources and expertise, leading to the rapid advancement of satellite technologies. For instance, initiatives in the United States have successfully leveraged private sector capabilities to enhance military satellite systems. This collaborative approach is likely to accelerate market growth, as it combines public funding with private innovation.

Growing Demand for ISR Capabilities

The demand for Intelligence, Surveillance, and Reconnaissance (ISR) capabilities is a critical factor influencing the Global Military Satellite Industry. Military operations increasingly rely on real-time intelligence gathered from satellites to inform strategic decisions. The proliferation of conflicts and asymmetric warfare has heightened the need for effective ISR systems. As a result, nations are investing in advanced satellite technologies that provide enhanced surveillance capabilities. This growing emphasis on ISR is expected to propel the market forward, aligning with the projected growth trajectory towards 30 USD Billion by 2035.