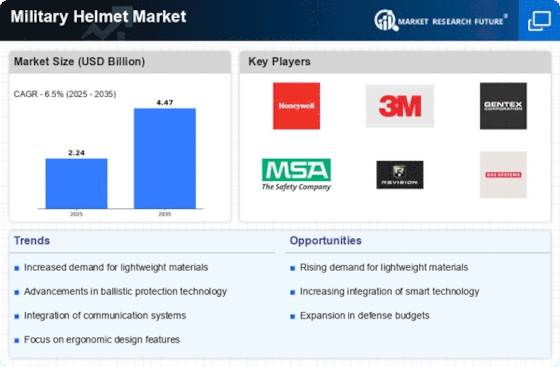

Rising Defense Budgets

The increasing defense budgets across various nations appears to be a primary driver for the Military Helmet Market. Countries are allocating more resources to enhance their military capabilities, which includes investing in advanced personal protective equipment. For instance, the defense budget of the United States has seen a consistent rise, reaching approximately 750 billion USD in 2025. This trend is mirrored in other nations, as they seek to modernize their armed forces. Consequently, the demand for high-quality military helmets is likely to surge, as these helmets are essential for soldier safety and operational effectiveness. The Military Helmet Market is thus positioned to benefit from this upward trajectory in defense spending, as governments prioritize the procurement of advanced protective gear.

Rising Geopolitical Tensions

Rising geopolitical tensions across various regions are contributing to the growth of the Military Helmet Market. As nations face increasing threats from both state and non-state actors, there is a pressing need to bolster military readiness. This has led to an uptick in military procurement, including personal protective equipment such as helmets. Countries are investing in advanced helmet technologies to ensure their forces are adequately protected in potential conflict scenarios. The ongoing conflicts and military engagements in different parts of the world further underscore the necessity for enhanced protective gear. Consequently, the Military Helmet Market is poised for growth as nations prioritize the safety and effectiveness of their armed forces in response to these geopolitical challenges.

Increased Focus on Soldier Safety

The heightened emphasis on soldier safety and survivability is a significant driver for the Military Helmet Market. As military operations become more complex and dangerous, the need for effective protective gear has never been more critical. Helmets are designed to protect against ballistic threats, blunt force trauma, and environmental hazards. Recent studies indicate that head injuries account for a substantial percentage of combat-related injuries, prompting military organizations to invest in better helmet technology. This focus on safety is likely to lead to increased procurement of advanced helmets, which incorporate innovative materials and designs. The Military Helmet Market is thus expected to expand as armed forces prioritize the health and safety of their personnel.

Growing Demand for Modular Helmet Systems

The growing demand for modular helmet systems is emerging as a key driver for the Military Helmet Market. Modular helmets allow for customization and adaptability, enabling soldiers to modify their gear based on mission requirements. This flexibility is particularly valuable in diverse operational environments, where different threats may be encountered. The ability to attach various accessories, such as visors, communication devices, and night vision equipment, enhances the overall functionality of the helmet. As military organizations recognize the benefits of modular systems, the market for these helmets is expected to expand. The Military Helmet Market is thus likely to see increased investment in modular designs that cater to the evolving needs of modern warfare.

Technological Innovations in Helmet Design

Technological innovations in helmet design are driving the evolution of the Military Helmet Market. Advances in materials science have led to the development of lighter, stronger, and more durable helmets. For example, the introduction of composite materials and advanced polymers has significantly improved the protective capabilities of military helmets. Additionally, features such as integrated communication systems and night vision compatibility are becoming increasingly common. These innovations not only enhance the functionality of helmets but also improve comfort and usability for soldiers in the field. As military forces seek to equip their personnel with the best possible gear, the demand for technologically advanced helmets is likely to grow, further propelling the Military Helmet Market.