Market Trends

Key Emerging Trends in the Military Helmet Market

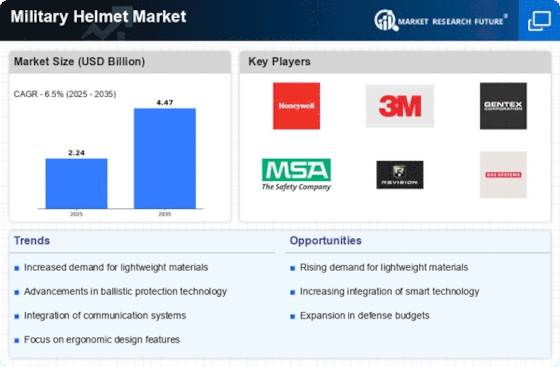

The Military Helmet market has witnessed notable growth in recent years, driven by a combination of technological advancements, increasing focus on soldier safety, and evolving military requirements. Modern military gear will not be complete without military helmets. They work to avert ballistic head injuries by reducing their forces and maintain the head from impact. Moreover, they can safeguard from different environmental hazards such as extreme heat, cold temperatures, and protecting from unknown threats. A mechanism for a better understanding of helmet design, materials, and functionality is the changing consumer patterns. These reflect the pattern, which outlines a continuous stride to improve the existing molds for helmet design, materials, and functionality.

The Military Helmet market is boosted by continuous development of improved materials which can reliably perform all the required functions and survive multiple impacts of modern battles. What have been sketched as new material types like aramid fibers, high-strength plastics, and composite materials allows it to be built and to remain strong even after being light weighted. These materials feature improved ballistic protection being ideal for the troops, who should not feel a need to remove helmets to avoid fatigue after a long period of wearing helmets. The hypothetical scenario is outline by the market trend which is running in the direction of helmets that give the best combination of protection and comfort that matches well with the ever-growing emphasis on the well-being of soldiers.

Emergence of armed helmets on the market is also an important trend. Helmet-mounted displays, communication ste defined as one group gaining dominance over another due to their superior qualities, values, or abilities. Through such innovative technological progresses, the battlefield conditions are now upgraded with the improve of the situational awareness, communication options, and the general operations aspect. Hence, there is a newly developing market that offers smart helmets that would capture information from other instruments in the same way as the human can interpret it.

Another point is that modular and customized design of helmets is attracting the attention of the consumers and is thereby becoming a powerful market trend. Throughout the world armed forces are discovering that they need to be more elastic and use different combinations of headgear dependent on mission set. Modular helmets are versatile, borrowed from the operational environment where they help soldiers to add accessories, adjust protective components or equip with any necessary additional feature. These days these findings demonstrate the transition to more orderly and flexible helmets solutions, responding to the truth that the dynamic of modern military operations is far from being simply a one sided issue.

Another indicator of the escalated global safety threats and on-going conflicts, an increasing number of assaults have contributed to rise in the demand for military helmets as well. The defense budget allocating resources for the latest modern military equipment, such as personal protection gear, fuel the economy for military helmets, hence. The states are importantly devoting their resources in the rebuilding of their body protection equipments with a helmet being a significant part of that effort. This trend in all its manifestations is especially pronounced in the areas where the security situation is harsher and the threat image is changing.

Moreover, the compliance with elevated testing and verification mechanisms is also the driving force in the military helmet market industry. Since head injury risks are getting more recognize, there is much more concern about tests that will ensure helmets comply with and even exceed the predetermined performance targeted. Manufacturers are responding to this trend by investing in research and development to create helmets that not only provide ballistic protection but also mitigate the risk of traumatic brain injuries.

Leave a Comment