Sustainability in Microelectronics Material Market

The increasing emphasis on sustainability is reshaping the Microelectronics Material Market. Manufacturers are now prioritizing eco-friendly materials and processes to reduce environmental impact. This shift is driven by regulatory pressures and consumer demand for greener products. For instance, the use of recyclable materials in semiconductor packaging is gaining traction, potentially leading to a market growth rate of 5% annually. Companies are investing in research to develop biodegradable materials, which could further enhance their market position. As sustainability becomes a core value, firms that adapt to these changes may find themselves at a competitive advantage, thereby influencing the overall dynamics of the Microelectronics Material Market.

Demand for Miniaturization in Microelectronics Material Market

The relentless demand for miniaturization is a key driver in the Microelectronics Material Market. As consumer electronics become increasingly compact, the need for smaller, lighter materials is paramount. This trend is particularly evident in the smartphone and wearable technology sectors, where space constraints drive innovation. The market for miniaturized components is projected to grow at a rate of 8% annually, indicating a robust demand for advanced materials that can meet these specifications. Manufacturers are focusing on developing thinner substrates and more efficient packaging solutions, which could redefine the landscape of the Microelectronics Material Market in the coming years.

Technological Advancements in Microelectronics Material Market

Technological advancements are a pivotal driver in the Microelectronics Material Market. Innovations in material science, such as the development of high-k dielectrics and advanced photolithography techniques, are enabling the production of smaller, more efficient electronic components. The market for advanced materials is projected to reach USD 100 billion by 2026, reflecting a compound annual growth rate of approximately 7%. These advancements not only enhance performance but also reduce energy consumption, aligning with the growing demand for energy-efficient devices. As technology continues to evolve, the Microelectronics Material Market is likely to experience significant transformations, driven by the need for cutting-edge materials.

Integration of Smart Technologies in Microelectronics Material Market

The integration of smart technologies is significantly influencing the Microelectronics Material Market. The rise of the Internet of Things (IoT) and smart devices necessitates the development of advanced materials that can support complex functionalities. This trend is expected to propel the market, with estimates suggesting a growth rate of 6% over the next five years. Materials that enable better connectivity and energy efficiency are in high demand, as they are essential for the performance of smart devices. Consequently, companies that innovate in this area may capture a larger share of the Microelectronics Material Market, reflecting the increasing interdependence between materials and technology.

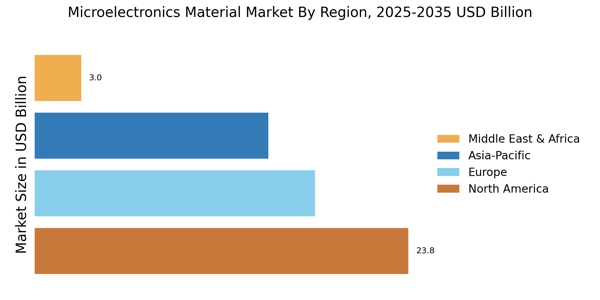

Emerging Markets and Economic Growth in Microelectronics Material Market

Emerging markets are playing a crucial role in the expansion of the Microelectronics Material Market. Rapid economic growth in regions such as Asia-Pacific and Latin America is driving increased investment in electronics manufacturing. This trend is expected to result in a market growth rate of 7% over the next five years. As these economies develop, the demand for consumer electronics and automotive applications is surging, necessitating a diverse range of microelectronics materials. Companies that strategically position themselves in these emerging markets may benefit from enhanced opportunities, thereby influencing the overall trajectory of the Microelectronics Material Market.