Labor Shortages

Labor shortages present a compelling driver for the Global Automated Material Handling Market AMH Market Industry. As industries face challenges in recruiting skilled labor, automation emerges as a viable solution to maintain productivity levels. Automated systems can operate continuously, alleviating the pressure on human resources. For instance, many manufacturing plants are implementing automated guided vehicles to transport materials, thereby reducing reliance on manual labor. This shift not only addresses labor shortages but also enhances safety and efficiency. The anticipated CAGR of 10.22% from 2025 to 2035 underscores the increasing reliance on automation in response to workforce challenges.

Sustainability Initiatives

Sustainability initiatives are becoming a pivotal driver for the Global Automated Material Handling Market AMH Market Industry. As environmental concerns gain prominence, companies are increasingly adopting automated solutions that reduce waste and energy consumption. For instance, automated systems can optimize energy use in warehouses, leading to lower carbon footprints. Furthermore, the integration of eco-friendly technologies in material handling processes aligns with corporate sustainability goals. This shift not only enhances operational efficiency but also meets the growing consumer demand for environmentally responsible practices. The market's evolution reflects this trend, as organizations prioritize sustainability in their automation strategies.

Technological Advancements

The Global Automated Material Handling Market AMH Market Industry experiences rapid growth due to continuous technological advancements. Innovations such as robotics, artificial intelligence, and the Internet of Things are revolutionizing material handling processes. For instance, autonomous mobile robots are increasingly utilized in warehouses, enhancing efficiency and reducing labor costs. The integration of advanced software solutions for inventory management further streamlines operations. As a result, the market is projected to reach 53.8 USD Billion in 2024, reflecting a growing demand for automation in logistics and manufacturing sectors.

Increased Demand for Efficiency

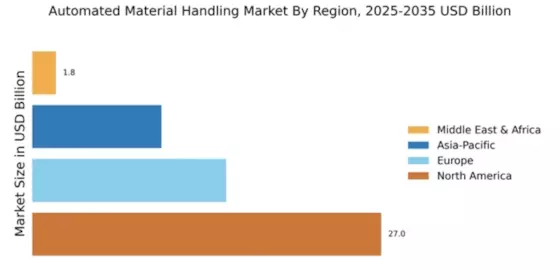

The Global Automated Material Handling Market AMH Market Industry is driven by an escalating demand for operational efficiency across various sectors. Companies are increasingly adopting automated solutions to minimize human error and optimize workflow. For example, automated storage and retrieval systems significantly enhance inventory management, leading to reduced operational costs. This trend is particularly evident in e-commerce and retail, where speed and accuracy are paramount. The market's growth trajectory suggests a potential valuation of 157.0 USD Billion by 2035, indicating that businesses recognize the necessity of automation to remain competitive.

Global Supply Chain Optimization

The Global Automated Material Handling Market AMH Market Industry is significantly influenced by the need for supply chain optimization. Companies are increasingly adopting automated solutions to enhance visibility and control over their supply chains. Technologies such as real-time tracking and automated sorting systems allow businesses to respond swiftly to market demands. For example, logistics firms are utilizing automated material handling systems to streamline operations and reduce lead times. This optimization is crucial in a globalized economy, where efficiency can determine competitive advantage. The market's growth reflects this trend, as organizations seek to leverage automation for improved supply chain performance.