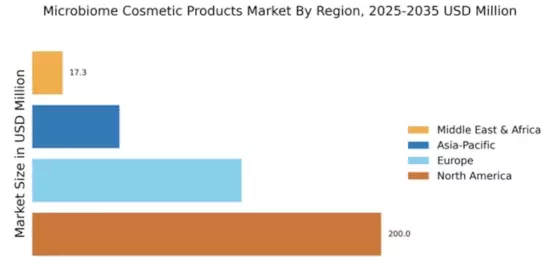

North America : Market Leader in Innovation

North America is poised to maintain its leadership in the Microbiome Cosmetic Products Market, holding a significant market share of $200.0M as of 2024. The region's growth is driven by increasing consumer awareness of skin health and the efficacy of microbiome-based products. Regulatory support for natural ingredients and sustainable practices further fuels demand, as consumers seek products that align with their values. The rise of e-commerce and digital marketing strategies also enhances product accessibility, contributing to market expansion. The competitive landscape in North America is robust, featuring key players such as Procter & Gamble, Estée Lauder, and Johnson & Johnson. These companies are investing heavily in R&D to innovate and expand their product lines. The U.S. remains the largest market, with Canada and Mexico also showing promising growth. The presence of established brands and a strong retail network ensures that consumers have access to a wide range of microbiome cosmetic products, solidifying North America's position as a market leader.

Europe : Emerging Market with Potential

Europe is witnessing a growing interest in microbiome cosmetic products, with a market size of $120.0M. This growth is driven by increasing consumer demand for natural and organic products, as well as a heightened awareness of skin microbiome health. Regulatory frameworks in the EU promote transparency and safety, encouraging brands to innovate while adhering to strict guidelines. The trend towards sustainability and eco-friendly products is also a significant driver, as consumers prioritize brands that align with their values. Leading countries in Europe include France, Germany, and the UK, where major players like L'Oreal and Beiersdorf are actively expanding their microbiome product lines. The competitive landscape is characterized by a mix of established brands and emerging startups, fostering innovation. The European market is expected to continue its upward trajectory as consumers increasingly seek products that support skin health and well-being, making it a key region for growth in the microbiome cosmetics sector.

Asia-Pacific : Emerging Powerhouse in Cosmetics

The Asia-Pacific region is emerging as a significant player in the Microbiome Cosmetic Products Market, with a market size of $50.0M. The growth is fueled by rising disposable incomes, increasing urbanization, and a growing awareness of skincare among consumers. Regulatory bodies are beginning to recognize the importance of microbiome-friendly products, which is expected to catalyze further market expansion. The trend towards natural and organic ingredients is also gaining traction, aligning with consumer preferences for healthier options. Countries like Japan, South Korea, and Australia are leading the charge in adopting microbiome cosmetics, with brands such as Shiseido and Unilever investing in innovative product development. The competitive landscape is vibrant, with both local and international brands vying for market share. As consumer education improves and demand for effective skincare solutions rises, the Asia-Pacific region is set to become a key market for microbiome cosmetics in the coming years.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region is still in the nascent stages of the Microbiome Cosmetic Products Market, with a market size of $17.32M. However, there is significant potential for growth driven by increasing consumer interest in skincare and wellness. The region's diverse demographics and rising disposable incomes are contributing to a shift towards premium and innovative cosmetic products. Regulatory frameworks are gradually evolving to accommodate new product categories, including microbiome-based cosmetics, which is expected to enhance market dynamics. Countries like South Africa and the UAE are at the forefront of this emerging market, with local and international brands exploring opportunities to introduce microbiome products. The competitive landscape is characterized by a mix of established players and new entrants, creating a dynamic environment for innovation. As awareness of the benefits of microbiome cosmetics grows, the Middle East and Africa are poised for significant market development in the coming years.