Advancements in Cooling Technologies

Advancements in cooling technologies are playing a pivotal role in the Micro Mobile Data Center Market. As data centers generate significant heat, efficient cooling solutions are essential for maintaining optimal performance and energy efficiency. Innovations in cooling systems, such as liquid cooling and advanced airflow management, are being integrated into micro mobile data centers. These advancements not only enhance the operational efficiency of data centers but also contribute to sustainability efforts by reducing energy consumption. The market is likely to benefit from these technological improvements, with a projected increase in market share of around 12% as organizations prioritize energy-efficient solutions.

Enhanced Disaster Recovery Solutions

In the Micro Mobile Data Center Market, the emphasis on disaster recovery solutions is becoming increasingly pronounced. Organizations are recognizing the necessity of having robust backup systems that can be deployed swiftly in the event of a disaster. Micro mobile data centers offer a viable solution, providing organizations with the ability to maintain operations during unforeseen circumstances. The market is witnessing a shift towards solutions that not only ensure data integrity but also facilitate business continuity. As businesses invest in these technologies, the demand for micro mobile data centers is expected to rise, potentially leading to a market expansion of around 15% in the coming years.

Growing Need for Temporary Data Centers

The Micro Mobile Data Center Market is significantly influenced by the growing need for temporary data centers. Various industries, including entertainment, construction, and events, require temporary IT infrastructure to support their operations. Micro mobile data centers provide a practical solution, allowing organizations to establish data processing capabilities without the long-term commitment of traditional data centers. This trend is particularly evident in sectors that experience fluctuating demands, where the ability to scale up or down quickly is essential. As a result, the market is projected to see an increase in adoption rates, with estimates suggesting a potential growth of 18% in the next few years.

Rising Demand for Mobile Infrastructure

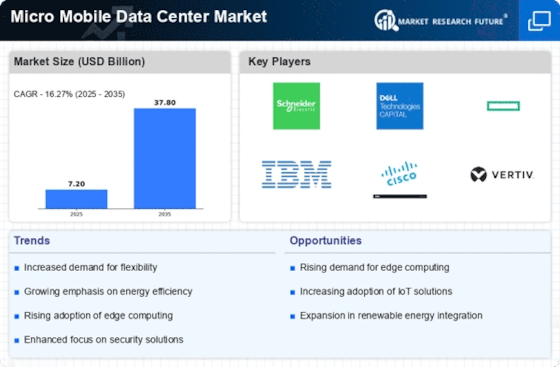

The Micro Mobile Data Center Market experiences a notable surge in demand for mobile infrastructure solutions. This trend is driven by the increasing need for rapid deployment of IT resources in various sectors, including telecommunications, healthcare, and education. Organizations are seeking flexible and scalable solutions that can be quickly set up in remote or temporary locations. According to recent estimates, the market for mobile data centers is projected to grow at a compound annual growth rate of approximately 20% over the next five years. This growth reflects the industry's response to the evolving landscape of digital transformation, where agility and speed are paramount.

Increased Focus on Security and Compliance

The Micro Mobile Data Center Market is witnessing an increased focus on security and compliance measures. As data breaches and cyber threats become more prevalent, organizations are prioritizing the protection of sensitive information. Micro mobile data centers offer enhanced security features, including physical security measures and advanced encryption technologies. This focus on security is particularly relevant for industries that handle sensitive data, such as finance and healthcare. As regulatory requirements continue to evolve, the demand for secure mobile data center solutions is expected to rise, potentially driving market growth by approximately 10% in the near future.