Top Industry Leaders in the Micro-LED Display Market

The Competitive Landscape of the Micro-LED Display Market

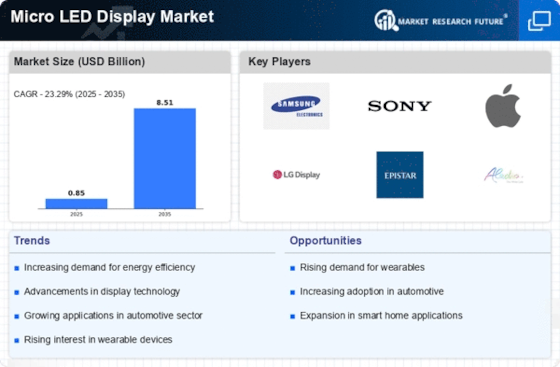

Micro-LED displays, once a glimmering vision of the future, are rapidly transitioning from sci-fi screens to a dynamic market brimming with potential. These diminutive giants, composed of microscopic light-emitting diodes (LEDs), boast unparalleled brightness, contrast, and modularity, revolutionizing everything from high-end televisions to augmented reality devices. Navigating this burgeoning landscape requires a keen understanding of the competitive dynamics, adopted strategies, key players, and emerging trends shaping the future of micro-LED technology.

Some of the Micro LED Display companies listed below:

- Apple

- Oculus VR

- Sony

- Samsung Electronics

- X-Celeprint

- Nanosys

- Jade bird display

- aledia

- mikro mesa

- verlase technologies

Strategies Adopted by Leaders:

- Embracing Innovation and Cutting-Edge Technologies: Investing in R&D to integrate novel advancements like micro-transfer printing for precise LED placement, self-driving displays with AI-powered image optimization, and transparent or curved micro-LED panels can differentiate solutions and cater to evolving user needs.

- Prioritizing User Experience and Ease of Use: Providing intuitive interfaces, user-friendly control systems, and seamless content mirroring from existing devices simplifies operation and enhances user satisfaction, particularly for non-technical audiences.

- Partnerships and Ecosystem Building: Collaborating with component manufacturers, software developers, content providers, and system integrators expands reach, offers complete solutions, and strengthens brand presence.

- Focus on Modular Design and Scalability: Developing modular micro-LED panels allows for customizable display sizes and configurations, catering to diverse applications and future-proofing against changing user preferences.

- Sustainability and Environmental Considerations: Utilizing energy-efficient LED technology, minimizing waste in production processes, and offering eco-friendly packaging cater to customers with growing sustainability concerns.

Factors for Market Share Analysis:

- Product Portfolio and Technological Breadth: The range and sophistication of display offerings, encompassing diverse sizes from microdisplays for smartwatches to wall-sized modular panels, and features like high-resolution video, HDR compatibility, and flexible substrates, significantly impact market reach. Catering to specific applications, such as cinema-quality home entertainment or immersive gaming experiences, can be significant differentiators.

- Target Market Focus: Focusing on specific segments within the technology ecosystem, such as consumer electronics, automotive displays, medical imaging, or industrial applications, requires tailored solutions and marketing strategies. Addressing the unique needs of each segment can solidify market share within that niche.

- Manufacturing Technology and Cost Efficiency: Developing efficient micro-LED fabrication processes, minimizing material waste, and optimizing production timelines are crucial for reducing costs and making micro-LED technology commercially viable across diverse applications.

- Software and System Integration: Robust software platforms for content management, modular panel configuration, and seamless integration with existing media systems ensure user experience and operational efficiency.

- Pricing Strategy and Service Packages: Striking the right balance between affordability and feature depth is essential. Offering flexible pricing models like tiered configurations, leasing options, or bundled packages with installation and maintenance services can broaden appeal and increase market penetration.

New and Emerging Companies:

- Niche-Focused Startups: Companies like PlayNitride and VueReal specialize in developing microdisplays for specific applications like augmented reality headsets or medical imaging equipment, offering customized features and performance optimized for demanding environments.

- Software-Centric Platforms: Companies like MicroVision and Ostendo Technologies focus on developing software platforms that optimize micro-LED content delivery, enable seamless panel configuration, and provide remote management capabilities, enhancing user experience and operational efficiency.

- Open-Source Hardware Advocates: Companies like TinyPilot and QMK promote open-source micro-LED hardware designs and readily available fabrication instructions, empowering researchers and DIY enthusiasts with customization options and fostering innovation within the community.

Latest Company Updates:

Oct.26, 2023, Microsoft announced that it is innovating its display technologies to reinvigorate its spatial communications devices. Microsoft has reportedly filed a new patent to develop a microLED display solution to enhance VR, AR, and MR experiences. The latest patent aims to improve device functionality like its HoloLens 2 and others.

Oct.09, 2023, Mojo Vision Inc., a startup micro-LED display technology developer, announced raising $21.1 million in fresh funding for its micro-LED display technology. Last year, the company decided to focus on commercializing its micro-LED design. The investment will enable Mojo Vision to continue enhancing its technology and accelerate commercialization efforts.

May 18, 2023, Apple announced its plan to mass produce its microLED displays to lessen its reliance on Samsung and increase its control over supply. Its ultimate goal is to bring the technology to iPhones. Apple has already spent over $1 BN on microLED R&D over the past decade, and once production starts, it will perform the critical mass transfer step of the manufacturing process, placing its tiny microLED chips onto substrates.

May 24, 2022, Samsung Electronics announced the opening of its huge micro-LED virtual production stage in South Korea in partnership with a leading media and entertainment company, CJ ENM. The studio offers a real-time experience for faster production turnarounds and reduced compositing costs. As the world of content production is constantly and rapidly evolving, virtual production stages are becoming increasingly popular. This technology looks crazy expensive at first glance, and its main goal is to cut down post-production times and costs for high-end productions.