Technological Advancements in Micro LED Display Market

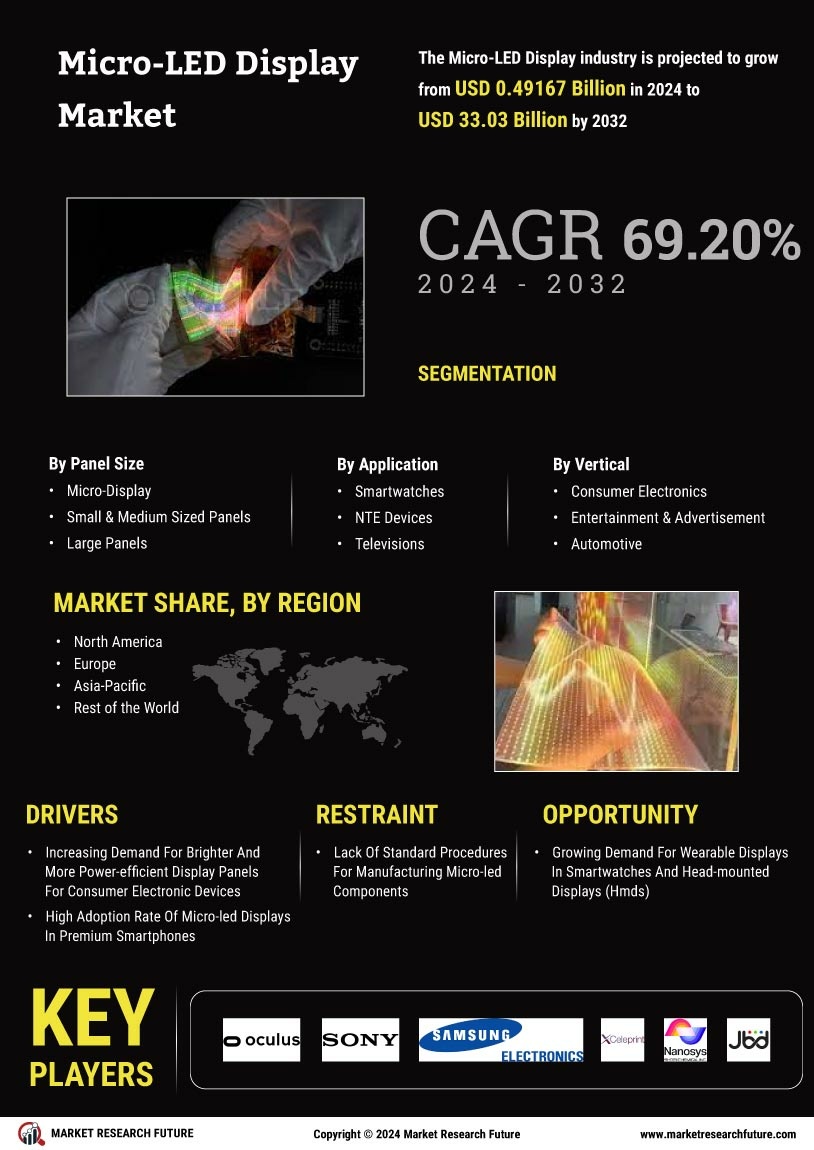

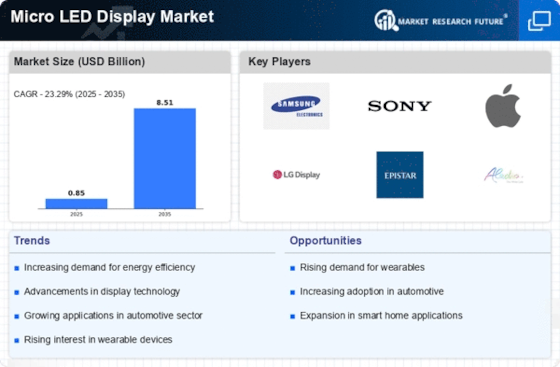

The Micro LED Display Market is experiencing rapid technological advancements that enhance display performance and efficiency. Innovations in microchip technology and manufacturing processes are leading to improved pixel density and color accuracy. For instance, the introduction of advanced epitaxial growth techniques has significantly reduced production costs, making micro LED displays more accessible. As a result, the market is projected to grow at a compound annual growth rate of approximately 30% over the next five years. These advancements not only improve the visual experience but also contribute to energy efficiency, which is increasingly important in consumer electronics. The integration of artificial intelligence in display technology further enhances user interaction, suggesting that the Micro LED Display Market is poised for substantial growth driven by these technological innovations.

Integration with Smart Technologies in Micro LED Display Market

The integration of micro LED displays with smart technologies is transforming the Micro LED Display Market. As smart devices proliferate, the need for displays that can seamlessly connect and interact with various platforms is becoming paramount. This integration allows for enhanced functionalities, such as voice control and smart home compatibility, which are increasingly sought after by consumers. The market for smart displays is projected to grow significantly, with micro LED technology playing a crucial role in this evolution. By 2025, it is anticipated that smart displays will account for a substantial portion of the overall display market, indicating a shift towards more interactive and connected viewing experiences. The Micro LED Display Market is thus likely to benefit from this trend as manufacturers develop products that cater to the growing demand for smart technology integration.

Rising Demand for High-Quality Displays in Micro LED Display Market

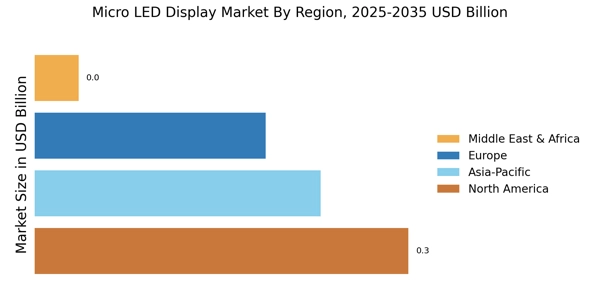

Consumer preferences are shifting towards high-quality displays, which is a key driver for the Micro LED Display Market. As consumers seek superior visual experiences for applications such as gaming, home entertainment, and professional displays, the demand for micro LED technology is surging. The market is expected to reach a valuation of over 10 billion dollars by 2026, reflecting a growing inclination towards displays that offer vibrant colors and high contrast ratios. This trend is particularly evident in sectors like automotive and advertising, where display quality can significantly impact consumer engagement. The Micro LED Display Market is thus responding to this demand by innovating and expanding product offerings to meet the expectations of discerning consumers.

Environmental Sustainability Trends Impacting Micro LED Display Market

Environmental sustainability is becoming a pivotal concern, influencing the Micro LED Display Market. As consumers and businesses alike prioritize eco-friendly products, the demand for displays that are energy-efficient and have a lower environmental impact is increasing. Micro LED technology is inherently more sustainable than traditional display technologies, as it consumes less power and has a longer lifespan. This aligns with global efforts to reduce electronic waste and carbon footprints. The market is likely to see a rise in products that emphasize sustainability, with manufacturers focusing on eco-friendly materials and production processes. By 2027, it is projected that sustainable products will constitute a significant share of the Micro LED Display Market, reflecting a shift towards environmentally responsible consumer choices.

Growing Applications in Various Industries within Micro LED Display Market

The Micro LED Display Market is witnessing a surge in applications across various sectors, including automotive, healthcare, and retail. This diversification is a significant driver of market growth, as micro LED technology offers unique advantages such as flexibility, lightweight design, and high brightness. In the automotive sector, for instance, micro LED displays are being utilized for advanced dashboard displays and infotainment systems, enhancing user experience and safety. In healthcare, these displays are being adopted for medical imaging and diagnostics, where clarity and precision are critical. The retail industry is also leveraging micro LED technology for dynamic advertising displays that attract consumer attention. This broadening of applications suggests that the Micro LED Display Market is not only expanding but also evolving to meet the specific needs of diverse sectors.