Aging Population and Nutritional Needs

Mexico's demographic landscape is shifting, with a significant increase in the aging population. This demographic change is influencing the vitamin supplements market, as older adults often require additional nutritional support to maintain their health. The market data suggests that the segment targeting seniors is projected to grow by 20% in the next five years. As the aging population seeks to address specific health concerns such as bone density and cognitive function, the vitamin supplements market industry is poised to expand its offerings tailored to meet these unique nutritional needs.

Expansion of Retail Distribution Channels

The expansion of retail distribution channels is playing a crucial role in the growth of the vitamin supplements market in Mexico. With an increasing number of health food stores, pharmacies, and supermarkets offering a diverse range of vitamin products, consumers have greater access to these supplements. Market data indicates that the number of retail outlets selling vitamin supplements has grown by 18% over the last two years. This expansion is likely to enhance consumer convenience and drive sales, thereby contributing to the overall growth of the vitamin supplements market industry.

Increasing Demand for Preventive Healthcare

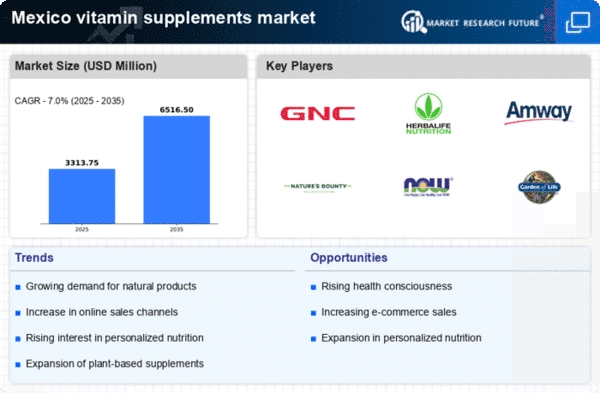

The vitamin supplements market in Mexico is experiencing a notable surge in demand driven by a growing awareness of preventive healthcare. Consumers are increasingly seeking ways to enhance their overall well-being and prevent chronic diseases through dietary supplements. This trend is reflected in the market data, which indicates that the demand for vitamin supplements has risen by approximately 15% over the past year. As individuals prioritize health maintenance, the vitamin supplements market industry is likely to benefit from this shift towards proactive health management, with consumers investing in products that support immune function, energy levels, and overall vitality.

Influence of Social Media and Digital Marketing

The vitamin supplements market in Mexico is increasingly influenced by social media and digital marketing strategies. As consumers turn to online platforms for health information and product recommendations, brands are leveraging these channels to engage with their audience. The market data shows that online sales of vitamin supplements have increased by 30% in the past year, highlighting the effectiveness of digital marketing in reaching potential customers. This trend suggests that the vitamin supplements market industry must continue to invest in digital strategies to enhance brand visibility and connect with health-conscious consumers.

Rising Popularity of Natural and Organic Products

There is a growing trend among Mexican consumers towards natural and organic products, which is significantly impacting the vitamin supplements market. As health-conscious individuals become more discerning about the ingredients in their supplements, the demand for products that are free from artificial additives and sourced from natural ingredients is on the rise. Market data indicates that organic vitamin supplements have seen a growth rate of 25% in recent years. This shift towards clean-label products is likely to drive innovation within the vitamin supplements market industry, as manufacturers adapt to meet consumer preferences for transparency and sustainability.