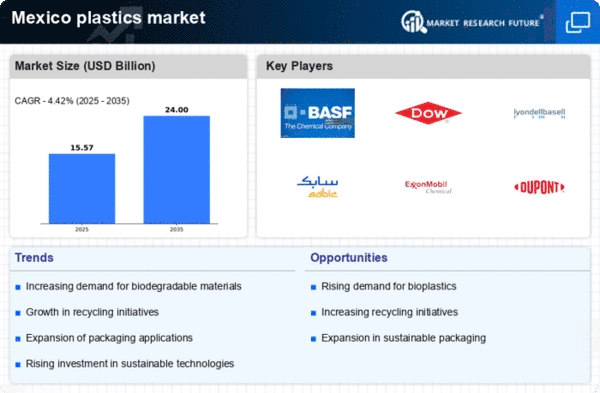

The plastics market in Mexico is characterized by a dynamic competitive landscape, driven by increasing demand across various sectors such as automotive, packaging, and construction. Key players are actively pursuing strategies that emphasize innovation, sustainability, and regional expansion. Companies like BASF SE (DE) and Dow Inc. (US) are focusing on developing advanced materials that cater to the growing need for lightweight and durable products. Their operational focus on sustainability is evident in their investments in bio-based plastics and recycling technologies, which collectively shape a competitive environment that prioritizes eco-friendly solutions.In terms of business tactics, localizing manufacturing and optimizing supply chains are critical for companies operating in this market. The competitive structure appears moderately fragmented, with several key players exerting influence over market dynamics. This fragmentation allows for niche players to emerge, while larger corporations leverage their scale to optimize production and distribution. The collective influence of these key players fosters a competitive atmosphere where innovation and efficiency are paramount.

In October LyondellBasell Industries N.V. (NL) announced a strategic partnership with a local Mexican firm to enhance its production capabilities in the region. This collaboration is expected to streamline operations and reduce lead times, thereby improving service delivery to customers. Such strategic moves indicate a growing trend towards localized production, which may enhance competitiveness by reducing costs and increasing responsiveness to market demands.

In September SABIC (SA) launched a new line of sustainable polymers designed for the packaging industry, which aligns with the increasing regulatory pressures for environmentally friendly materials. This initiative not only positions SABIC as a leader in sustainability but also reflects a broader industry trend towards the adoption of circular economy principles. The strategic importance of this launch lies in its potential to capture market share in a segment that is rapidly evolving due to consumer preferences for sustainable products.

In August ExxonMobil Chemical Company (US) unveiled a new technology aimed at improving the efficiency of its polyethylene production processes. This technological advancement is likely to enhance production capacity while reducing environmental impact, thereby reinforcing ExxonMobil's competitive edge in the market. The emphasis on technological innovation suggests a shift towards more efficient manufacturing processes, which could redefine competitive dynamics in the plastics sector.

As of November current trends in the plastics market indicate a strong focus on digitalization, sustainability, and the integration of artificial intelligence in production processes. Strategic alliances are increasingly shaping the landscape, allowing companies to pool resources and expertise to drive innovation. The competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological advancements, sustainability initiatives, and supply chain reliability. This shift underscores the importance of adapting to changing market demands and consumer preferences, positioning companies for long-term success.