Regulatory Support

Regulatory frameworks promoting energy efficiency and sustainable building practices are likely to bolster the Metal Structural Insulation Panel Market. Governments worldwide are implementing stricter building codes and standards aimed at reducing energy consumption in buildings. These regulations often incentivize the use of high-performance materials, including metal structural insulation panels, which comply with energy efficiency criteria. For instance, initiatives such as tax credits and grants for energy-efficient construction are becoming more prevalent. This supportive regulatory environment suggests that the Metal Structural Insulation Panel Market may experience accelerated growth as stakeholders seek to align with compliance requirements and capitalize on available incentives.

Diverse Applications

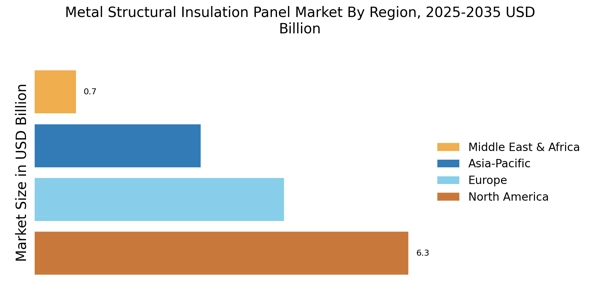

The versatility of metal structural insulation panels is emerging as a key driver for the Metal Structural Insulation Panel Market. These panels are increasingly utilized across various sectors, including residential, commercial, and industrial applications. Their lightweight nature and ease of installation make them suitable for a wide range of building types, from warehouses to high-rise buildings. Market analysis reveals that the commercial construction sector is expected to account for a substantial share of the market, driven by the need for energy-efficient solutions in urban development. This diverse applicability indicates that the Metal Structural Insulation Panel Market is well-positioned to capitalize on the expanding construction landscape.

Sustainability Focus

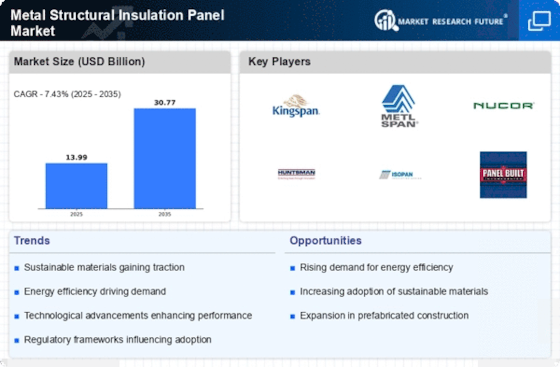

The increasing emphasis on sustainability within the construction sector appears to be a pivotal driver for the Metal Structural Insulation Panel Market. As environmental concerns escalate, builders and architects are increasingly seeking materials that not only meet energy efficiency standards but also contribute to reduced carbon footprints. Metal structural insulation panels, known for their superior thermal performance, align well with these sustainability goals. Reports indicate that the demand for energy-efficient building materials is projected to grow at a compound annual growth rate of approximately 7% over the next five years. This trend suggests that the Metal Structural Insulation Panel Market is likely to benefit from heightened awareness and regulatory pressures aimed at promoting sustainable construction practices.

Technological Advancements

Technological advancements in manufacturing processes and materials science are driving innovation within the Metal Structural Insulation Panel Market. Enhanced production techniques, such as automated manufacturing and improved insulation materials, have led to panels that are not only lighter but also exhibit superior thermal and acoustic properties. The integration of smart technologies, such as sensors for energy management, is also gaining traction. Market data indicates that the adoption of advanced manufacturing technologies could potentially increase production efficiency by up to 30%. This evolution in technology suggests that the Metal Structural Insulation Panel Market is on the cusp of significant transformation, enabling manufacturers to meet the growing demands for high-performance building solutions.

Economic Growth and Urbanization

Economic growth and urbanization trends are contributing to the expansion of the Metal Structural Insulation Panel Market. As economies develop, there is a marked increase in construction activities, particularly in urban areas where housing and commercial space demand is surging. The rise in disposable incomes and population growth in urban centers is driving the need for efficient and cost-effective building solutions. Market forecasts indicate that the construction sector is poised for robust growth, with an expected increase in investment in infrastructure projects. This economic momentum suggests that the Metal Structural Insulation Panel Market is likely to thrive as it meets the demands of a rapidly urbanizing population.