Durability and Longevity

Durability remains a pivotal factor influencing the Global Metal Roofing Market Industry. Metal roofs are renowned for their longevity, often lasting over 50 years with minimal maintenance. This characteristic appeals to both residential and commercial property owners seeking long-term investments. The ability of metal roofing to withstand extreme weather conditions, such as heavy rain, snow, and high winds, further enhances its appeal. As a result, the market is likely to experience growth as more consumers recognize the cost-effectiveness of investing in durable roofing solutions. This trend suggests that the Global Metal Roofing Market could see a compound annual growth rate of 4.18% from 2025 to 2035.

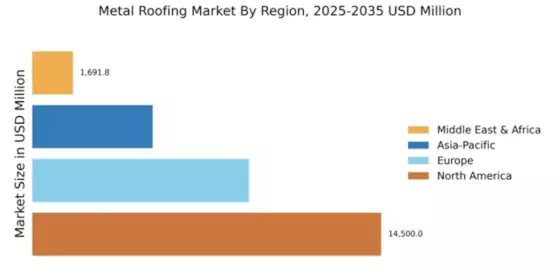

Market Growth Projections

The Global Metal Roofing Market Industry is poised for substantial growth, with projections indicating a market value of 29.2 USD Billion in 2024 and an anticipated increase to 45.8 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 4.18% from 2025 to 2035. Such figures reflect the increasing adoption of metal roofing solutions across various sectors, driven by factors such as sustainability, durability, and technological advancements. The market's expansion is indicative of a broader trend towards energy-efficient and long-lasting building materials, positioning metal roofing as a key player in the construction industry.

Technological Advancements

Technological advancements play a crucial role in shaping the Global Metal Roofing Market Industry. Innovations in manufacturing processes and materials have led to the development of lightweight, high-strength metal roofing options that are easier to install and more efficient. Additionally, advancements in coatings and finishes enhance the aesthetic appeal and performance of metal roofs, making them more attractive to consumers. These technological improvements not only increase the lifespan of metal roofs but also contribute to energy efficiency. As a result, the market is expected to expand, with projections indicating a growth to 45.8 USD Billion by 2035, driven by these advancements.

Rising Construction Activities

The Global Metal Roofing Market Industry is significantly influenced by the rising construction activities across the globe. Urbanization and population growth are leading to increased demand for residential and commercial buildings, which in turn drives the need for roofing materials. Metal roofing, known for its durability and energy efficiency, is becoming a preferred choice among builders and architects. This trend is particularly pronounced in developing regions where infrastructure development is accelerating. As construction activities continue to rise, the demand for metal roofing is expected to grow, contributing to the overall expansion of the market.

Government Initiatives and Regulations

Government initiatives and regulations aimed at promoting energy efficiency and sustainable building practices are pivotal in shaping the Global Metal Roofing Market Industry. Many governments worldwide are implementing policies that encourage the use of energy-efficient materials in construction. These regulations often include incentives for builders and homeowners who choose sustainable roofing options, such as metal roofs. As these initiatives gain traction, they are likely to stimulate demand for metal roofing solutions. Consequently, the market is expected to benefit from these supportive policies, further solidifying the role of government in driving market growth.

Sustainability and Environmental Concerns

The Global Metal Roofing Market Industry is increasingly driven by sustainability and environmental considerations. Metal roofing materials are often recyclable, which aligns with the growing demand for eco-friendly construction practices. As consumers and builders prioritize sustainable options, metal roofing emerges as a favorable choice. This trend is particularly evident in regions where regulations promote green building standards. The shift towards energy-efficient roofing solutions is expected to bolster the market, as metal roofs can reflect solar heat, thereby reducing energy consumption. Consequently, the Global Metal Roofing Market is projected to reach 29.2 USD Billion in 2024, highlighting the importance of sustainability in driving market growth.