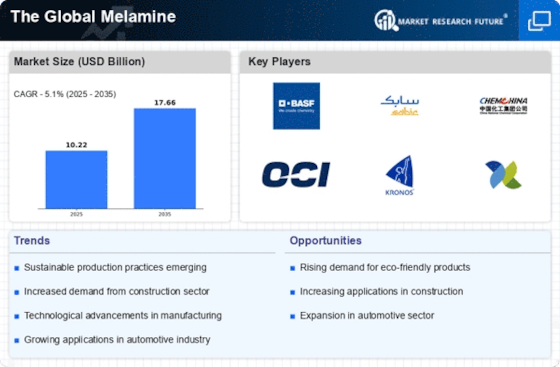

Growth in Furniture Manufacturing

The furniture manufacturing sector is witnessing a robust expansion, which is contributing positively to The Global Melamine Industry. Melamine Market is favored for its versatility and durability, making it a preferred choice for producing various types of furniture, including cabinets, tables, and chairs. The increasing consumer preference for stylish and functional furniture is driving manufacturers to incorporate melamine in their designs. Market analysis reveals that the furniture industry is expected to grow at a rate of around 4.8% annually, which could lead to a heightened demand for melamine products. This growth trajectory indicates that The Global Melamine Industry is poised to capitalize on the evolving trends in furniture design and production, as companies strive to offer innovative and sustainable solutions.

Rising Demand in Construction Sector

The construction sector is experiencing a notable surge in demand for melamine, primarily due to its application in producing durable and aesthetically pleasing materials. Melamine Market is extensively utilized in laminates, particle boards, and other composite materials, which are essential for modern construction projects. As urbanization accelerates, the need for high-quality building materials increases, thereby driving The Global Melamine Industry. Recent data indicates that the construction industry is projected to grow at a compound annual growth rate of approximately 5.5% over the next five years, further enhancing the demand for melamine-based products. This trend suggests that The Global Melamine Industry is likely to benefit significantly from the ongoing construction boom, as manufacturers seek to meet the rising needs of builders and developers.

Technological Innovations in Production

Technological advancements in the production processes of melamine are playing a crucial role in shaping The Global Melamine Industry. Innovations such as improved synthesis methods and enhanced processing techniques are enabling manufacturers to produce melamine more efficiently and with higher quality. These advancements not only reduce production costs but also enhance the performance characteristics of melamine-based products. For instance, the introduction of eco-friendly production methods aligns with the increasing demand for sustainable materials. As a result, The Global Melamine Industry is likely to experience growth driven by these technological innovations, which may lead to the development of new applications and markets for melamine.

Expansion of Consumer Electronics Market

The consumer electronics market is undergoing rapid expansion, which is creating new opportunities for The Global Melamine Industry. Melamine Market is increasingly being used in the production of electronic components and casings due to its excellent thermal stability and electrical insulation properties. As the demand for electronic devices continues to rise, manufacturers are seeking materials that can meet the stringent requirements of this sector. Market forecasts indicate that the consumer electronics industry is expected to grow at a compound annual growth rate of around 7% over the next few years, suggesting a potential increase in the demand for melamine-based products. This growth trajectory indicates that The Global Melamine Industry is likely to benefit from the ongoing advancements and innovations in consumer electronics.

Increasing Applications in Automotive Industry

The automotive industry is increasingly recognizing the benefits of melamine, which is being utilized in various applications such as interior components and insulation materials. The lightweight and durable nature of melamine makes it an attractive option for manufacturers aiming to enhance vehicle performance and fuel efficiency. As the automotive sector continues to evolve, the demand for innovative materials is expected to rise, thereby positively impacting The Global Melamine Industry. Recent projections suggest that the automotive market will grow at a rate of approximately 6% annually, which could lead to a significant increase in the consumption of melamine products. This trend indicates that The Global Melamine Industry may find new opportunities for growth within the automotive sector.