Top Industry Leaders in the Melamine Market

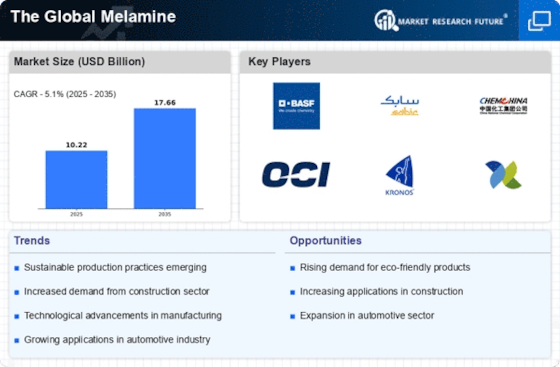

The global melamine market is driven by rising demand for durable, lightweight, and cost-effective materials. This growth presents a dynamic competitive landscape, with established players and emerging entrants vying for market share. Let's delve into this landscape, exploring key strategies, market share factors, industry news, and recent developments.

Competitive Strategies:

-

Product Innovation: Manufacturers are constantly innovating to offer melamine products with improved properties like heat resistance, scratch resistance, and flame retardancy. Examples include formaldehyde-free melamine resins and bio-based melamine alternatives. -

Geographical Expansion: Major players are expanding their presence in emerging markets like Asia Pacific and Latin America, where demand for melamine is rapidly growing. This involves establishing production facilities, forming partnerships, and tailoring product offerings to local preferences. -

Sustainability Initiatives: As environmental concerns rise, companies are adopting sustainable practices like using recycled materials, reducing energy consumption, and minimizing waste generation. This focus on sustainability attracts environmentally conscious consumers and helps build brand image. -

Mergers and Acquisitions: Consolidation is a trend in the melamine market, with leading players acquiring smaller companies to expand their product portfolio, geographical reach, and market share.

Factors Influencing Market Share:

-

Production Capacity: Leading players with large production capacities have a cost advantage and can cater to larger orders. They can also invest more in research and development. -

Brand Recognition: Established brands with strong brand recognition and customer loyalty enjoy a significant advantage in the market. -

Product Quality and Consistency: Consistent high-quality products are crucial for gaining customer trust and repeat business. -

Cost-Competitiveness: Balancing product quality with competitive pricing is essential in a market sensitive to price fluctuations. -

Distribution Network: Having a robust and efficient distribution network ensures wider product reach and timely delivery to customers.

Key Companies in the Melamine market include

- Haohua Junhua Group Co Ltd.(China)

- OCI Nitrogen (Netherlands)

- BASF SE (Germany)

- Prefere Resins Holding GmbH

- Xinji JiuYuan chemical industry Co., Ltd

- OCI Nitrogen

- Cornerstone Chemical Company (U.S.)

- Qatar Melamine Company (Qatar)

- Sichuan Golden Elephant Chemical (China)

- Mitsui Chemicals Inc. (Japan)

- Nissan Chemical Industries. LTD. (Japan)

- Methanol Holdings (Trinidad) Limited (U.S.)

- Borealis AG (Austria), among others

Recent Developments:

-

June 2023: Astec Industries, a major melamine tableware manufacturer, announced a new production facility in Vietnam to cater to the growing demand in Southeast Asia. -

July 2023: The Chinese government announced plans to invest in green infrastructure projects, which is expected to boost demand for melamine resins used in construction materials. -

September 2023: The melamine market faced supply chain disruptions due to port congestion and rising shipping costs. -

November 2023: Researchers developed a new method for recycling melamine waste, potentially reducing the environmental impact of the industry. -

January 2024: The melamine market is expected to see increased competition from bio-based alternatives, driven by government regulations and consumer preferences for sustainable products.