Changing Consumer Behavior

The Medical Vending Machines Market is influenced by changing consumer behavior, particularly the shift towards self-service solutions. Consumers increasingly prefer the convenience of purchasing medical supplies without the need for interaction with sales personnel. This trend is supported by data showing that self-service kiosks and vending machines have seen a 25% increase in usage in recent years. As more individuals seek quick and discreet access to health products, the Medical Vending Machines Market is likely to expand, catering to the evolving preferences of consumers who value efficiency and privacy.

Technological Advancements

The Medical Vending Machines Market is experiencing a surge in technological advancements that enhance user experience and operational efficiency. Innovations such as touchless interfaces, mobile app integration, and real-time inventory management systems are becoming commonplace. These technologies not only streamline the purchasing process but also improve the accessibility of medical supplies. According to recent data, the integration of advanced technologies in vending machines has led to a 30% increase in user engagement. This trend suggests that as technology continues to evolve, the Medical Vending Machines Market will likely see further growth, driven by consumer demand for convenience and efficiency.

Regulatory Support and Compliance

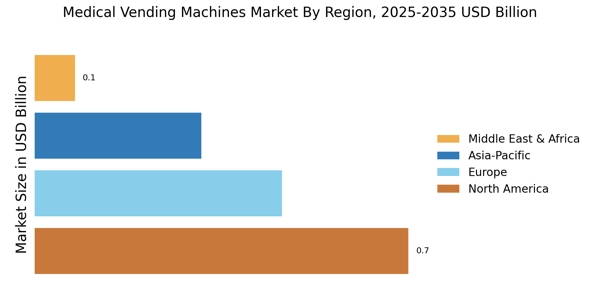

The Medical Vending Machines Market is supported by regulatory frameworks that promote the use of vending machines for medical supplies. Governments are increasingly recognizing the importance of accessible healthcare solutions, leading to policies that facilitate the deployment of medical vending machines in various settings. Compliance with health regulations ensures that these machines provide safe and effective products to consumers. Data suggests that regions with supportive regulatory environments have seen a 20% increase in the installation of medical vending machines. This regulatory support is likely to bolster the Medical Vending Machines Market, encouraging further investment and innovation.

Increased Demand for Health Products

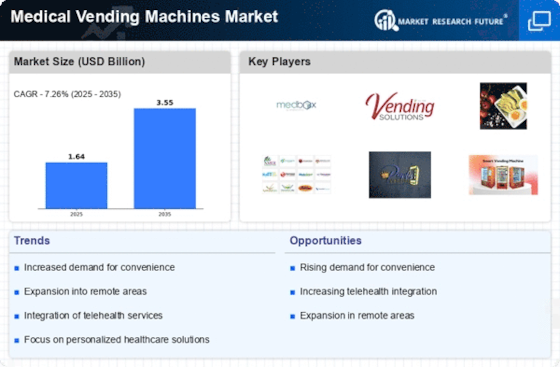

The Medical Vending Machines Market is witnessing a notable increase in demand for health-related products. As consumers become more health-conscious, the need for easy access to medical supplies, over-the-counter medications, and wellness products is rising. Market data indicates that the health and wellness sector is projected to grow at a compound annual growth rate of 8% over the next five years. This growth is likely to propel the Medical Vending Machines Market, as these machines provide a convenient solution for consumers seeking immediate access to health products, particularly in high-traffic areas such as airports and shopping centers.

Strategic Partnerships and Collaborations

The Medical Vending Machines Market is benefiting from strategic partnerships and collaborations between manufacturers and healthcare providers. These alliances enable the distribution of vending machines in hospitals, clinics, and other healthcare facilities, enhancing accessibility to medical supplies. Recent reports suggest that partnerships have led to a 40% increase in the placement of medical vending machines in healthcare settings. This trend indicates that as healthcare providers recognize the value of vending machines in improving patient care, the Medical Vending Machines Market will likely experience accelerated growth through expanded distribution channels.