Market Growth Projections

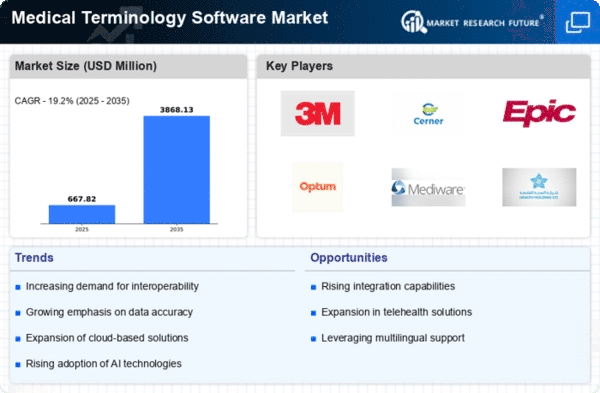

The Global Medical Terminology Software Market Industry is poised for substantial growth, with projections indicating a market size of 0.56 USD Billion in 2024 and an anticipated increase to 3.54 USD Billion by 2035. This represents a compound annual growth rate of 18.25% from 2025 to 2035. Such growth is driven by various factors, including advancements in technology, regulatory compliance, and the increasing demand for interoperability in healthcare systems. The market's expansion reflects the critical role of medical terminology software in enhancing healthcare delivery and improving patient outcomes.

Expansion of Telehealth Services

The expansion of telehealth services is reshaping the Global Medical Terminology Software Market Industry. As telehealth becomes a mainstream mode of healthcare delivery, the need for accurate and standardized medical terminology is paramount. Telehealth platforms require robust software solutions to ensure effective communication between patients and providers. This demand is expected to propel the market forward, as healthcare organizations invest in technologies that support remote consultations and digital health records. The ongoing growth of telehealth is likely to create new opportunities for medical terminology software providers.

Rising Demand for Interoperability

The Global Medical Terminology Software Market Industry experiences a notable increase in demand for interoperability among healthcare systems. As healthcare providers strive to enhance patient care, the integration of diverse medical terminologies becomes essential. This trend is driven by the need for seamless data exchange and communication between various healthcare entities. In 2024, the market is projected to reach 0.56 USD Billion, reflecting the growing recognition of the importance of standardized medical terminology. The push for interoperability is likely to continue, as it facilitates better clinical decision-making and improves patient outcomes.

Growing Focus on Patient-Centric Care

The shift towards patient-centric care is significantly influencing the Global Medical Terminology Software Market Industry. Healthcare providers are increasingly recognizing the importance of understanding patient needs and preferences. Medical terminology software facilitates better communication and documentation, allowing for a more personalized approach to care. This trend is likely to drive the adoption of such software, as it enables providers to tailor treatments based on comprehensive patient data. The market's growth trajectory suggests a robust future, as patient-centered practices become integral to healthcare delivery.

Regulatory Compliance and Standardization

Regulatory compliance is a critical driver for the Global Medical Terminology Software Market Industry. Governments and health organizations worldwide are implementing stringent regulations to ensure the accuracy and consistency of medical data. Compliance with standards such as SNOMED CT and LOINC is essential for healthcare providers to avoid penalties and enhance patient safety. As a result, the demand for medical terminology software that supports these standards is on the rise. This trend is expected to contribute to a compound annual growth rate of 18.25% from 2025 to 2035, reflecting the increasing importance of regulatory adherence in healthcare.

Advancements in Health Information Technology

Technological advancements play a pivotal role in shaping the Global Medical Terminology Software Market Industry. Innovations in health information technology, including artificial intelligence and machine learning, enhance the capabilities of medical terminology software. These technologies enable more accurate coding, improved data retrieval, and better clinical documentation. As a result, healthcare organizations are increasingly adopting these solutions to streamline operations and reduce errors. The market is expected to grow significantly, with projections indicating a rise to 3.54 USD Billion by 2035, driven by the ongoing evolution of health IT.