Growing Focus on Telemedicine

The rise of telemedicine is reshaping the landscape of healthcare delivery, significantly impacting the Medical Imaging Software Market. As remote consultations become more prevalent, the need for efficient imaging solutions that can be accessed and shared digitally is paramount. Medical imaging software that supports telehealth applications enables healthcare professionals to review and interpret images remotely, facilitating timely diagnoses and treatment plans. This shift is particularly relevant in rural and underserved areas, where access to specialized care may be limited. The market is anticipated to expand as healthcare systems increasingly adopt telemedicine platforms that integrate advanced imaging capabilities, thereby enhancing patient access to quality care and improving overall healthcare outcomes.

Rising Demand for Diagnostic Imaging

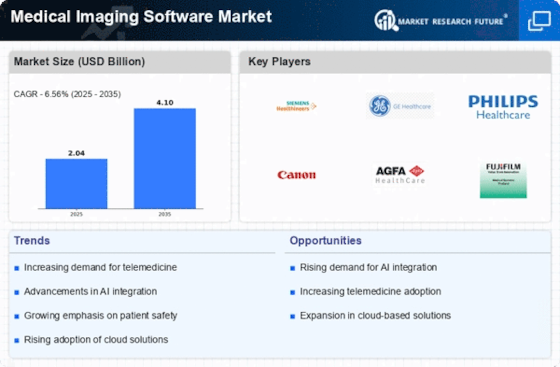

The increasing prevalence of chronic diseases and the aging population are driving the demand for diagnostic imaging services. As healthcare providers seek to enhance patient outcomes, the Medical Imaging Software Market is experiencing significant growth. According to recent estimates, the market is projected to reach a valuation of approximately USD 45 billion by 2026. This surge is attributed to the need for accurate and timely diagnoses, which are facilitated by advanced imaging technologies. Consequently, healthcare institutions are investing in sophisticated medical imaging software to improve diagnostic accuracy and operational efficiency. The integration of these software solutions is essential for managing the vast amounts of imaging data generated, thereby enhancing the overall quality of care.

Technological Advancements in Imaging Techniques

Technological innovations in imaging modalities, such as MRI, CT, and ultrasound, are propelling the Medical Imaging Software Market forward. The introduction of high-resolution imaging and 3D visualization techniques has revolutionized diagnostic capabilities. These advancements not only improve the precision of diagnoses but also reduce the time required for image acquisition and analysis. As a result, healthcare providers are increasingly adopting advanced medical imaging software to leverage these technologies. The market is expected to witness a compound annual growth rate (CAGR) of around 7% over the next few years, driven by the continuous evolution of imaging technologies. This trend underscores the importance of integrating cutting-edge software solutions to optimize imaging workflows and enhance patient care.

Increased Investment in Healthcare Infrastructure

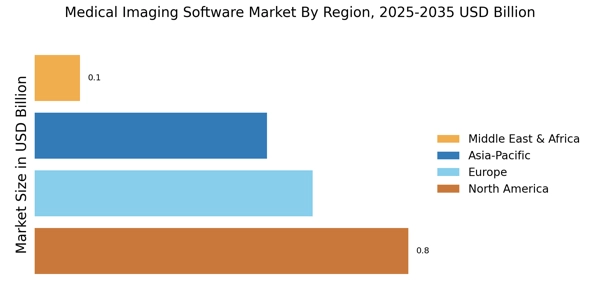

Investment in healthcare infrastructure is a critical driver of growth in the Medical Imaging Software Market. Governments and private entities are allocating substantial resources to modernize healthcare facilities and enhance diagnostic capabilities. This trend is particularly evident in emerging markets, where the demand for advanced medical imaging solutions is surging. The establishment of new hospitals and diagnostic centers is creating opportunities for the deployment of state-of-the-art imaging software. Furthermore, the integration of these solutions into healthcare systems is essential for improving operational efficiency and patient care. As the healthcare sector continues to evolve, the emphasis on upgrading imaging infrastructure is expected to sustain the momentum of the medical imaging software market.

Regulatory Support for Advanced Imaging Technologies

Regulatory bodies are increasingly recognizing the importance of advanced imaging technologies in improving healthcare delivery. The Medical Imaging Software Market benefits from supportive regulations that promote the adoption of innovative imaging solutions. Initiatives aimed at streamlining the approval process for new imaging software and technologies are encouraging investment in research and development. This regulatory environment fosters innovation, allowing companies to bring cutting-edge medical imaging software to market more efficiently. As a result, healthcare providers are more likely to adopt these advanced solutions, which can lead to improved diagnostic accuracy and patient outcomes. The ongoing collaboration between regulatory agencies and industry stakeholders is likely to further enhance the growth trajectory of the market.