Rising Healthcare Expenditure

The increasing healthcare expenditure across various regions appears to be a pivotal driver for the Medical Sterile Glove Market. As nations allocate more resources to healthcare, the demand for medical supplies, including sterile gloves, is likely to rise. In 2025, healthcare spending is projected to reach unprecedented levels, with estimates suggesting a growth rate of approximately 5% annually. This trend indicates that healthcare facilities are investing more in quality and safety, thereby propelling the need for high-quality medical sterile gloves. Furthermore, as hospitals and clinics expand their services, the volume of procedures requiring sterile gloves increases, further stimulating market growth. The Medical Sterile Glove Market is thus positioned to benefit from this upward trajectory in healthcare investment.

Regulatory Standards and Compliance

The stringent regulatory standards governing the production and use of medical supplies are a crucial driver for the Medical Sterile Glove Market. Regulatory bodies are continuously updating guidelines to ensure the safety and efficacy of medical products. Compliance with these regulations is essential for manufacturers, as non-compliance can lead to significant penalties and loss of market access. In 2025, it is anticipated that regulatory scrutiny will intensify, compelling manufacturers to invest in quality assurance and control measures. This focus on compliance not only enhances product safety but also fosters consumer trust in medical sterile gloves. Consequently, the Medical Sterile Glove Market is expected to grow as manufacturers align their practices with evolving regulatory requirements.

Growing Demand from Emerging Markets

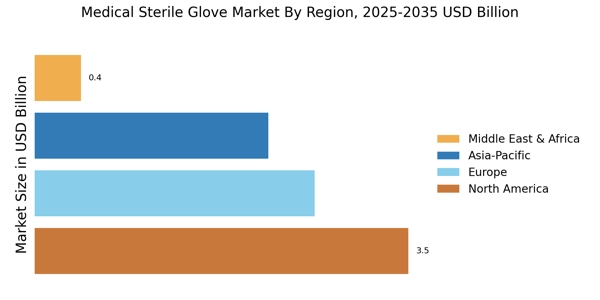

The increasing demand for medical sterile gloves from emerging markets is a notable driver for the Medical Sterile Glove Market. As economies develop, there is a corresponding rise in healthcare infrastructure and services. Countries in Asia and Africa are witnessing rapid growth in healthcare facilities, leading to a surge in the consumption of medical supplies, including sterile gloves. Market analysis suggests that the demand in these regions could grow by over 8% annually through 2025. This trend indicates a shift in the market dynamics, as manufacturers seek to expand their reach into these burgeoning markets. The Medical Sterile Glove Market is thus poised for growth, driven by the rising healthcare needs in emerging economies.

Increased Awareness of Infection Control

The heightened awareness surrounding infection control and prevention is a significant driver for the Medical Sterile Glove Market. With the rise in healthcare-associated infections (HAIs), healthcare providers are increasingly prioritizing safety protocols. Studies indicate that the use of sterile gloves can reduce the risk of HAIs by up to 70%. This awareness has led to stricter adherence to safety guidelines, resulting in a surge in demand for medical sterile gloves. As healthcare facilities implement more rigorous infection control measures, the Medical Sterile Glove Market is likely to experience substantial growth. The emphasis on patient safety and the prevention of cross-contamination is expected to further solidify the role of sterile gloves in medical settings.

Technological Innovations in Glove Manufacturing

Technological advancements in glove manufacturing processes are transforming the Medical Sterile Glove Market. Innovations such as the introduction of synthetic materials and enhanced production techniques are improving the quality and performance of sterile gloves. For instance, the development of nitrile gloves has gained traction due to their superior puncture resistance and allergy-free properties. The market for nitrile gloves is projected to grow at a compound annual growth rate (CAGR) of around 6% through 2025. These advancements not only enhance the safety and comfort of healthcare professionals but also expand the range of applications for medical sterile gloves. As manufacturers continue to innovate, the Medical Sterile Glove Market is likely to witness increased competition and product differentiation.