Market Growth Projections

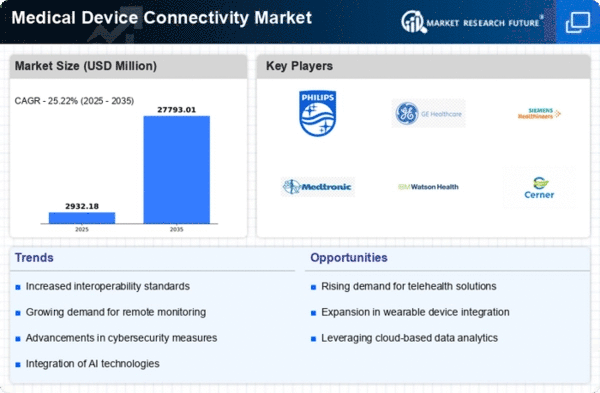

The Global Medical Device Connectivity Market Industry is poised for substantial growth, with projections indicating a market value of 5.86 USD Billion in 2024 and a remarkable increase to 15.2 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 9.05% from 2025 to 2035, driven by various factors including technological advancements, increasing demand for remote patient monitoring, and a growing focus on data security. The market's expansion is indicative of the healthcare sector's ongoing transformation towards more connected, efficient, and patient-centric solutions.

Growing Prevalence of Chronic Diseases

The rising prevalence of chronic diseases significantly influences the Global Medical Device Connectivity Market Industry. Chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders necessitate continuous monitoring and management, thereby increasing the demand for connected medical devices. These devices enable healthcare providers to track patient health metrics and intervene proactively, improving patient outcomes. The market's growth trajectory is further supported by the anticipated compound annual growth rate of 9.05% from 2025 to 2035, reflecting the increasing reliance on technology to manage chronic diseases effectively. This trend underscores the importance of connectivity in modern healthcare.

Rising Demand for Remote Patient Monitoring

The Global Medical Device Connectivity Market Industry experiences a notable surge in demand for remote patient monitoring solutions. As healthcare systems increasingly prioritize patient-centric care, the integration of connected medical devices facilitates real-time health monitoring. This trend is underscored by the projected market value of 5.86 USD Billion in 2024, reflecting a growing recognition of the benefits of remote monitoring. Connected devices enable healthcare providers to track patient vitals, thereby enhancing clinical decision-making and improving patient outcomes. The shift towards telehealth solutions further propels this demand, as patients seek convenient and efficient healthcare delivery.

Technological Advancements in Medical Devices

Technological innovations play a pivotal role in shaping the Global Medical Device Connectivity Market Industry. The advent of advanced sensors, wireless communication technologies, and cloud computing has transformed traditional medical devices into smart, interconnected systems. These advancements not only enhance device functionality but also improve data accuracy and security. For instance, the integration of Internet of Things (IoT) capabilities allows devices to communicate seamlessly, enabling healthcare professionals to access critical patient data in real-time. As the industry evolves, the market is expected to grow significantly, with projections indicating a value of 15.2 USD Billion by 2035, driven by continuous technological enhancements.

Increasing Focus on Data Security and Compliance

Data security and compliance are paramount considerations within the Global Medical Device Connectivity Market Industry. As medical devices become increasingly interconnected, the risk of cyber threats escalates, prompting manufacturers to prioritize robust security measures. Regulatory bodies are also enhancing compliance requirements to safeguard patient data. This focus on security not only protects sensitive information but also fosters trust among healthcare providers and patients. The industry's commitment to data integrity is likely to drive market growth, as stakeholders seek solutions that comply with stringent regulations while ensuring the secure exchange of health information.

Enhanced Healthcare Efficiency and Cost Reduction

The Global Medical Device Connectivity Market Industry is driven by the need for enhanced healthcare efficiency and cost reduction. Connected medical devices streamline workflows, reduce manual errors, and facilitate better resource allocation within healthcare settings. By automating data collection and analysis, these devices enable healthcare professionals to focus on patient care rather than administrative tasks. This efficiency not only improves patient satisfaction but also contributes to overall cost savings for healthcare systems. As organizations seek to optimize operations and reduce expenditures, the adoption of connected devices is expected to rise, further propelling market growth.