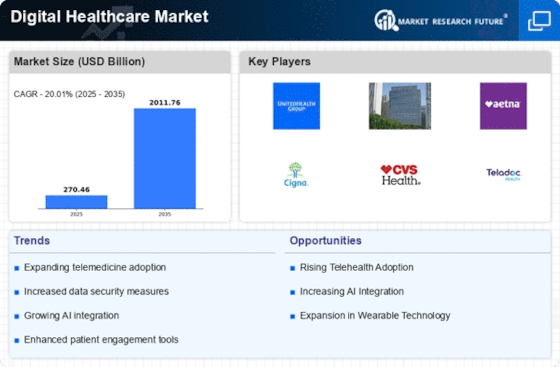

The Digital Healthcare Market is currently characterized by a dynamic competitive landscape, driven by rapid technological advancements and an increasing demand for efficient healthcare solutions. Key players such as UnitedHealth Group (US), Teladoc Health (US), and Cerner Corporation (US) are at the forefront, each adopting distinct strategies to enhance their market positioning.

- UnitedHealth Group (US) focuses on integrating technology with healthcare services, emphasizing telehealth and data analytics to improve patient outcomes.

- Meanwhile, Teladoc Health (US) is expanding its telemedicine offerings, aiming to provide comprehensive virtual care solutions.

- Cerner Corporation (US) is concentrating on electronic health record (EHR) innovations, enhancing interoperability to streamline healthcare processes.

Collectively, these strategies contribute to a competitive environment that prioritizes innovation and patient-centric solutions.

Business Tactics and Market Structure

In terms of business tactics, companies are increasingly localizing their operations and optimizing supply chains to enhance service delivery. The Digital Healthcare Market appears moderately fragmented, with a mix of established players and emerging startups. This structure allows for diverse offerings, yet the influence of major companies remains substantial, as they leverage their resources to set industry standards and drive technological advancements.

Recent Strategic Moves (July–September 2025)

UnitedHealth Group (US)

In August 2025, UnitedHealth Group (US) announced a strategic partnership with a leading AI firm to develop predictive analytics tools aimed at improving patient care management. This move is likely to enhance their service offerings, allowing for more personalized healthcare solutions and potentially reducing costs associated with chronic disease management. The integration of AI into their operations may also position UnitedHealth Group (US) as a leader in data-driven healthcare solutions.

Teladoc Health (US)

In September 2025, Teladoc Health (US) launched a new platform that integrates mental health services with primary care, reflecting a growing recognition of the importance of holistic health approaches. This initiative not only broadens their service portfolio but also addresses the increasing demand for mental health support, thereby enhancing patient engagement and satisfaction. Such a comprehensive approach could significantly differentiate Teladoc Health (US) in a competitive market.

Cerner Corporation (US)

In July 2025, Cerner Corporation (US) unveiled a new interoperability framework designed to facilitate seamless data exchange among healthcare providers. This strategic initiative is crucial as it addresses one of the most pressing challenges in healthcare today—data silos. By enhancing interoperability, Cerner Corporation (US) is likely to improve care coordination and patient outcomes, reinforcing its position as a key player in the digital healthcare landscape.

Current Competitive Trends (As of October 2025)

As of October 2025, the competitive trends in the Digital Healthcare Market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in driving innovation. Looking ahead, competitive differentiation is expected to evolve, shifting from traditional price-based competition to a focus on technological innovation, enhanced patient experiences, and reliable supply chains. This transition underscores the necessity for companies to adapt and innovate continuously in order to maintain a competitive edge.

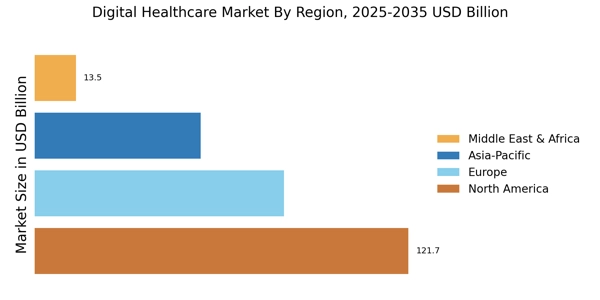

Asia-Pacific: Rapidly Growing Market

Asia-Pacific is witnessing a rapid surge in the digital healthcare market, accounting for about 20% of the global share. The region's growth is driven by increasing smartphone penetration, rising healthcare expenditure, and a growing focus on preventive care. Government initiatives, such as the Digital India program, are promoting the adoption of telehealth and electronic health records, enhancing access to healthcare services across diverse populations. Countries like China, India, and Japan are leading the charge in digital health innovations. The competitive landscape is marked by a mix of established healthcare providers and emerging tech companies, with significant investments in health tech startups. The region's diverse healthcare needs and varying regulatory environments present both challenges and opportunities for digital health solutions.

Middle East and Africa: Emerging Digital Health Frontier

The Middle East and Africa are emerging as a frontier for digital healthcare, holding approximately 5% of the global market share. The region's growth is driven by increasing internet penetration, mobile health adoption, and government initiatives aimed at improving healthcare access. Countries like the UAE and South Africa are leading the way, with investments in telemedicine and health information systems, supported by regulatory frameworks that encourage innovation. The competitive landscape features a mix of local and international players, with significant contributions from companies like Healthigo and Vezeeta. The region's unique challenges, such as varying healthcare infrastructure and regulatory environments, create opportunities for tailored digital health solutions that address specific needs and improve patient outcomes.